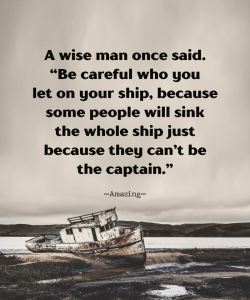

Grade Point Avg By Cannabis Use

Karen Hadley writes: I found this chart in my research. You can see that a person who uses marijuana daily (green bar all the way to the right) will typically have significantly lower grades than a person who does not (green bar all the way to the left). Therefore it follows that if you want to be a success in school and in life, leave the pot alone. That’s the simple fact, summed up in this one chart.

Silicon Valley Bank, aka SIVB Crashes.

The beginning of the end for the US$ and fiat currencies? The story so far and analysis.

Before You Get Married

Grow Strong Roots

We Do Best When We Create

Do you have some creative time in your schedule? Do you make sure your kids spend some time each day creating rather than consuming entertainment?

What will happen when banks go bust? Bank runs, bail-ins and systemic risk.

I recommend you read this article and start taking steps to reduce your exposure to a banking crisis.

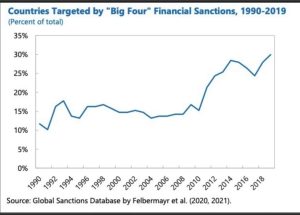

Sanctioned Countries

Countries being sanctioned by USA from trading in US Dollars. if this isn’t a reason for counties to abandon the petro dollar as international currency what is?

Meanwhile… those countries are draining the gold reserves.

The big question now is how long can fiat currency maintain its illusion?

Countries facing economic sanctions include:

1. Afghanistan

2. Belarus

3. Bosnia and Herzegovina

4. Burundi

5. Central African Republic

6. China (PR)

7. Comoros

8. Crimea Region of Ukraine

9. Cuba

10. Cyprus

11. Democratic Republic of the Congo

12. Guinea

13. Guinea Bissau

14. Haiti

15. Iran

16. Iraq

17. Kyrgyzstan

18. Laos

19. Lebanon

20. Libya

21. Mali

22. Mauritania

23. Moldova

24. Montenegro

25. Myanmar

26. Nicaragua

27. North Korea – DPRK

28. Palestinian Territories

29. Russia

30. Rwanda

31. Serbia

32. Somalia

33. South Sudan

34. Sudan

35. Syria

36. Tunisia

37. Venezuela

38. Yemen

39. Zimbabwe

Tribal People or Size Matters by Jeff Thomas

Recently, Doug Casey commented, in an essay, on the senselessness of giving to organized charities. I take a similar view. So, are we both heartless, having no concern for the well-being of others? Not at all.

Personal generosity is a laudable quality, but giving to a large organized charity is just plain foolish. At best, three-quarters of your donation will be gobbled up by the administration of the charity. If you genuinely wish to be of value to others, your generosity would be more effective on a local level, where you give directly to those who will benefit from it, and you’re more certain of the outcome. The larger the charity organization, the greater the certainty that much, if not all, of your donation will fail to reach those you hoped would benefit.

Similarly, the concept of community is that we surround ourselves with others, as this provides us with a better life. The concept originated before mankind even existed—lions hunting in a pride, monkeys shrieking at the approach of a predator, etc. Humans originally formed tribes for similar reasons. Then, the idea of community expanded as some individuals proved to be better at different tasks. One might have been a more proficient hunter, whilst another constructed a better shelter or made better tools.

This, in turn, developed into the idea of a fixed community, with some buildings being used as dwellings and others as places of business. The more people, the greater the diversity of skills and the greater the choice of whom to seek out, to fulfill tasks.

Hence, we develop the assumption that “bigger is better.” But, at some point, as a community grows larger, we find that depersonalisation occurs. We find that we have little personal relationship with the folks on the other side of town and our willingness to help them diminishes, as we come to realise that the favour is unlikely to be returned.

The effectiveness of “community” is based on the level of voluntary give-and-take.

This concept is reinforced in a situation where we live our entire lives in the same location, increasing the likelihood that we’ll be surrounded by family members, including in-laws and friends and associates with whom we develop symbiotic relationships over a period of years. The longer those relationships exist, the less immediacy we require on a return within the give-and-take.

The logical conclusion of “bigger is better” is city life, in which people come and go frequently and each individual becomes more solitary in his view as to what type of behaviour is most useful to him. The larger the population, the more the sense of “community” dries up.

Although a high-population community can function effectively, it tends to come apart in times of strife. If a riot occurs, your car is more likely to be senselessly burned by someone you don’t know and have never harmed. Likewise, during a food crisis, your neighbour is more likely to shoot you to gain the loaf of bread you’re taking home.

So, somewhere between city living and “going it alone,” there’s an ideal size for a community, where neighbours are likely to help one another as needed, because they recognise the likelihood of a return on their “social investment.”

In the US, the Amish have arguably been more successful at this than anyone else. Whenever a community exceeds forty or so families, they begin the formation of another church district (community). This assures that each person benefits personally from the assistance of the others, even to the extent that the entire community gets together to raise a barn for a young married couple, without charging them. (At some point in everyone’s life, the favour has either been returned, or will be.)

The English country village has my personal endorsement as the most civilised form of community man has ever created, as it has one of every service that’s needed, but little more. But, although I’m British, I choose not to live in an English village, because they all fall under the aegis of a controlling and impersonal national government, within which I have no meaningful voice. Worse, at least for the present, that national government falls under the control of an even more dictatorial uber-government—the EU.

For a community to have an effective government, it would never grow beyond the level of the town hall—a meeting place in which each resident’s voice has a similar weight. (Even then, it would stand the risk of being more a democracy than a republic.)

But, as soon as a community grows beyond that size, the individual has an ever-decreasing say in managing his own affairs. In addition, he faces decreasing interplay between himself and his fellow citizens, leaving him ever more greatly exposed in those times when mutual respect and assistance may be essential.

Today, we’re approaching a period that will include the greatest level of social, economic and political change that we’ll ever face in our lifetimes. Whilst it will impact us all, the primary objective should be to minimize its impact on us so that we can come out the other side of it as undamaged as possible. (If we prepare ourselves well enough, we may even exit this period in a better position than we now have.)

In such a time, it would be wise to have the option to live in a small community, where we’re known and our involvement is respected. As conditions become more difficult, our voluntary participation in the survival and/or betterment of the community would be the glue that keeps its function ongoing. (And, here, I cannot stress the word, “voluntary” strongly enough. A community that has laws and regulations that demand contribution is a poor choice, regardless of its size.)

For someone living in the UK, the odds of surviving well in, say, Winchcombe (population 4,500) are far better than in Manchester, a large, entitlement-conscious mill town of 2.6 million.

In the US, quiet, largely self-sufficient Jackson County, Florida (population 48,600) is a much better bet than Miami-Dade (population 2.7 million), a location that has considerable strife in the best of times and is only likely to worsen in a crisis.

But even a community that’s known to be peaceable may come under the control of a larger government. Central governments routinely regard small communities as being milk cows in the best of times and expendable in the worst of times.

In order to minimise such risk, there are two options. The first is to find a small community in a country where the central government, however large it may be, is ineffectual—a community that largely ignores edicts delivered from the Capitol.

The second choice is to find a small country—a country too small to have a military and that has an appropriately small central government where the individual voice is easily heard.

Lastly, it’s important to note that, in the event of a global crisis, it will do little good to arrive in such a community after the crisis has already begun. This earns you a reputation as a refugee, running from a problem elsewhere.

Instead, it’s necessary to put down roots in such a community, even if it’s only part of each year; to gain acceptance during better times and to develop a genuine interplay between yourself and your community.

In choosing a community, size matters—especially during a crisis. A viable size dictates the opportunity of a good life during difficult times. The achievement of that good life is determined by how well you become a part of that community.

It’s Never Too Late