As an entrepreneur, my income has always been feast or famine. For years at the start of a new company, I would earn literally nothing. Now sure, employees had to be paid, and all the business had to move forward, but I took no compensation.

I survived on savings. Luckily I had some. Made from the years of feast. If there’s one thing that makes it hard for most people to be entrepreneurs, it’s this “feast or famine” income volatility. (Still worth it.)

During the COVID hysteria and seeing what’s coming, I decided to totally upend my life. For the first four years and up until fairly recently, I was in a period of personal income famine.

Encouraged by Doug, we launched a few new businesses, including our paid investment newsletter at CrisisInvesting.com. Things have improved. I wouldn’t call it a feast, but it’s enough to cover three hots and a cot.

What Is a Livable Income Today?

How much do you really need to make to live a reasonably prosperous life?

In our trips back to the U.S., I would often comment to my wife: “I don’t know how people can afford any of this.” Prices had gone up so much on virtually everything you can imagine, from food to housing, car insurance, health insurance. It’s insane. Insane enough that I started saying no to travel or new purchases I never would’ve given two seconds’ thought to before.

Admittedly, I’m in a position where these prices are much more of an irritant than a real impediment to my life. But I have eyes and a heart. I look around, I see what’s happening, and I’m worried. I’m worried not for myself, but for the fabric of society itself and all the individuals that are trapped. These individuals include not just random strangers, but friends and family, people I love. From my mom and dad who are retired and in poor health but who worked hard their whole lives. To my siblings whose careers are at risk of the shaky economy and who are being slowly subsumed by the steadily rising prices of all things.

Two years ago, while in the US, I thought, “how are people earning less than $100,000 a year making ends meet.”

A hundred grand is, or at least was, a lot of money. You were in a privileged status to have that kind of earnings power. And yet today, you can earn a hundred grand and be on the cusp of legitimate poverty.

Macro strategist Michael Green made this clear in his recent essay, “Part One: My Life as a Lie — How a Broken Benchmark Quietly Broke America.” I strongly encourage you to read it.

Michael wanted to know more about Americans’ poverty statistics. Perhaps he’d been asking himself many of the questions I had. How are people making it? What he discovered is shocking and disturbing, but totally believable.

According to Uncle Sam, if you’re a family of four earning $30,000 a year, you are living below the poverty line. If you’re above that line, theoretically, you’re doing okay. Not great, but you can survive. As Michael demonstrates, that simply is not true. In fact, it takes a lot more income to stay out of poverty in America today.

As a general rule, when you see a statistic, figure out how it’s calculated. That’s what Michael Green did here, and he learned that the official poverty line is calculated based upon a 1963 formula developed by Mollie Orshansky, an economist at the Social Security Administration.

The government estimated the cost of basic food diet for a family. In 1963 households spent 1/3 of their income on food. From there, the formula multiplied that amount by three to account for other living expenses. The formula looks like this: (Food cost in 1963) * 3 + CPI = Poverty line.

For 2024 that number is $31,200.

As Michael says:

“For 1963, that floor made sense. Housing was relatively cheap. A family could rent a decent apartment or buy a home on a single income, as we’ve discussed. Healthcare was provided by employers and cost relatively little (Blue Cross coverage averaged $10/month). Childcare didn’t really exist as a market—mothers stayed home, family helped, or neighbors (who likely had someone home) watched each other’s kids. Cars were affordable, if prone to breakdowns. With few luxury frills, the neighborhood kids in vo-tech could fix most problems when they did. College tuition could be covered with a summer job. Retirement meant a pension income, not a pile of 401(k) assets you had to fund yourself. The food-times-three formula was crude, but as a crisis threshold—a measure of “too little”—it roughly corresponded to reality. A family spending one-third of its income on food would spend the other two-thirds on everything else, and those proportions more or less worked. Below that line, you were in genuine crisis. Above it, you had a fighting chance.

But everything changed between 1963 and 2024.”

So what’s changed? Housing is now incredibly expensive. Healthcare has become the largest household expense for many families. Childcare ballooned into a $70b industry and a huge expense for families with children. College went from affordable to where now the average of a four-year degree might cost you the net worth of the median American household.

But that’s not all, the requirement for a second income became mandatory in order to provide the standard of living that we were able to achieve before. But a second income means secondary costs. It means two cars become a requirement which means even more insurance. And who’s going to watch the children while both parents are at work? That’s where the $70 billion a year child care industrial complex comes in, consuming a huge portion of American family budgets.

All these new costs are like the price of admission to the American economy and have fundamentally changed the composition of household spending since 1963. The one upside, I guess, is that food costs are no longer a third of household spending. For most families, it’s just 5 to 7 percent. While housing is 35 to 50%, health care takes 20%, and child care can eat 20 to 40% of a family’s budget.

word-image-68599-1.png

And so we get to the problem with that poverty line model created in 1963. Michael puts it this way:

“If you keep Orshansky’s logic—if you maintain her principle that poverty could be defined by the inverse of food’s budget share—but update the food share to reflect today’s reality, the multiplier is no longer three.

It becomes sixteen.

Which means if you measured income inadequacy today the way Orshansky measured it in 1963, the threshold for a family of four wouldn’t be $31,200.

It would be somewhere between $130,000 and $150,000.

And remember: Orshansky was only trying to define “too little.” She was identifying crisis, not sufficiency. If the crisis threshold—the floor below which families cannot function—is honestly updated to current spending patterns, it lands at $140,000.

What does that tell you about the $31,200 line we still use?

It tells you we are measuring starvation.”

Since the official poverty line for a family of four is $31,200 and the median income is roughly $80,000, we’re led to believe that a family that’s earning 80k a year is doing fine. Or at least surviving, as a stable middle class family.

But as Michael demonstrates above, a family of four living with $80,000 a year would in fact be living in deep poverty according to 1963 methodology.

Yesterday I talked to a friend whose family income was $160,000 a year. They’re living right on the financial edge. Have they made some bad financial decisions? Yes. Did they take on debt they shouldn’t have? Yes. But they are not living large. And there is always this feeling that they are on the brink of falling down.

Ask yourself, does it make more sense, based upon your personal experience, that $140,000 a year in America today is the actual poverty line and living below that line puts you at risk of poverty and destitution? Above that like you’re more likely to be reasonably secure.

Michael’s analysis didn’t stop with updating the 1963 methodology to today’s reality. He went further:

“I wanted to see what would happen if I ignored the official stats and simply calculated the cost of existing. I built a Basic Needs budget for a family of four (two earners, two kids). No vacations, no Netflix, no luxury. Just the ‘Participation Tickets’ required to hold a job and raise kids in 2024.

Using conservative, national-average data:

Childcare: $32,773

Housing: $23,267

Food: $14,717

Transportation: $14,828

Healthcare: $10,567

Other essentials: $21,857

Required net income: $118,009

Add federal, state, and FICA taxes of roughly $18,500, and you arrive at a required gross income of $136,500.

This is Orshansky’s ‘too little’ threshold, updated honestly. This is the floor.”

According to Michael, families are in a trap. To reach the median household income of $80,000, most families need two earners. But the moment you add a second earner to chase that income, you trigger the child care expense. And that child care expense is crushing. Roughly $32,000 a year.

In practice, the second earner is working to pay the stranger watching their children so they can go to work in some soul-crushing job merely to earn an extra $1,000 to $2,000 a month.

In two different models, updating the 1963 methodology for today’s household food-share percentages puts the poverty threshold at $130,000 to $150,000 a year. The second, a line item of reasonable expenses calculated by Michael gets us to $135,000 a year.

I found his analysis extremely convincing and spent a portion of our Crisis Investing VIP call last Monday discussing it with the group. I was looking for pushback from the dozens of people on the call. I got none. They all agreed. The real poverty line in America is $140,000 a year.

In his article, Michael Green goes on to explain some justification for numbers he uses to calculate the gross income needs and provides plenty of backup for his numbers. If anything, he’s being conservative.

The Cost of Participation

In addition, he makes the point that the cost to simply participate in the economy is far higher than is estimated.

He uses the example of the hedonic lie, why a phone costs $200, not $58. He says to function in a 1955 society, to have a job, call a doctor, and be a citizen, you needed a telephone line. That participation ticket cost $5 a month. Adjust it for standard inflation, that $5 should be $58 today. But he says you cannot run a household in 2024 on a landline. To function today, to two-factor authenticate your bank account, to answer work emails, to check your child’s school portal, which is now digital only, you need a smartphone plan and home broadband. So today, that cost of participation for a family of four is not $58, it’s at least $200 a month. Quite the “upgrade.”

He goes on to cover the skyrocketing health care costs, which in 1955 were $10 a month or $115 adjusted for inflation. But today, the average family’s premium is over $1,600 a month, which is four times the rate of inflation.

Up until very recently, I maintained health insurance for my family, even though we hadn’t been to the U.S. in well over a year and rarely used insurance at all. But that insurance cost me nearly $3,000 a month. I cancelled it and saved myself a bundle.

Insurance must be one of the biggest scams out there. $3,000 a month for health insurance I never used, and if I did, the deductibles would be at least $10,000. And car insurance, after decades and decades of paying at least $10,000 a year in auto insurance for all my vehicles. I never had a single claim. And yet, even this year, for my cars in storage in the U.S., my insurance went up.

Taxes, too, are a requirement of participation in the economy. In 1955, the Social Security tax was 2% on the first $4,200 of income. The maximum contribution was $84 a year. Adjusted for inflation, that’s about $960. But today, a family earning the median $80,000 pays over $6,100. That’s six times the rate of inflation.

Taxes, insurance, child care, the fact that the median car in America sells for over $50,000, car insurance, cell phones, and housing expenses consuming 35% to 50% of income—these are the costs of participation, the entrance fee you must pay simply to earn a living and maybe, just maybe, reach escape velocity someday.

For a median family, the “Cost of Participation” in the economy is roughly $50,000 a year.

The Broken Welfare System

Michael goes on to explain the sinister ways in which the welfare system locks people in to certain levels of income and makes it virtually impossible for them to escape.

“The family earning $65,000—the family that just lost their (childcare) subsidies and is paying $32,000 for daycare and $12,000 for healthcare deductibles—is hyper-aware of the family earning $30,000 and getting subsidized food, rent, childcare, and healthcare.

They see the neighbor at the grocery store using an EBT card while they put items back on the shelf. They see the immigrant family receiving emergency housing support while they face eviction.

They are not seeing ‘poverty.’ They are seeing people getting for free the exact things that they are working 60 hours a week to barely afford.”

Like it or not, we’re motivated by financial incentives. If you’re earning $30,000 a year and getting subsidized food, rent, child care, and health care, and you choose to put your nose to the grindstone and increase your income by 25% to, say, $40,000, the loss of benefits would actually end up costing you $200. A $10k raise equals a $200 loss.

And it gets worse from there. If through great effort you can push your income up from $30,000 to the $65,000 level, you lose the vast majority of benefits ending up worse off on a net basis.

So here you are at $65,000, well below the median and far, far below the real poverty line in America and taking home an income that would generate the same rewards as earning just $30,000/yr and collecting the benefits from Uncle Sam.

102,500,000 Americans Opted Out

As Michael points out, this should dispel your curiosity about why workforce participation rates are so shockingly low in America today. This is a measure of the working age population that is not employed and not actively looking for work. That’s 36% of the working-age population in America who are not employed and not even looking for a job. Over 100 million people.

It’s easy to scorn these people as freeloaders. But the fact is, maybe they’ve just done the math, and working harder just isn’t worth it. The bar they have to exceed is seen as too high, too out of reach. The $50,000 ticket to participate in the economy? Unachievable in their minds.

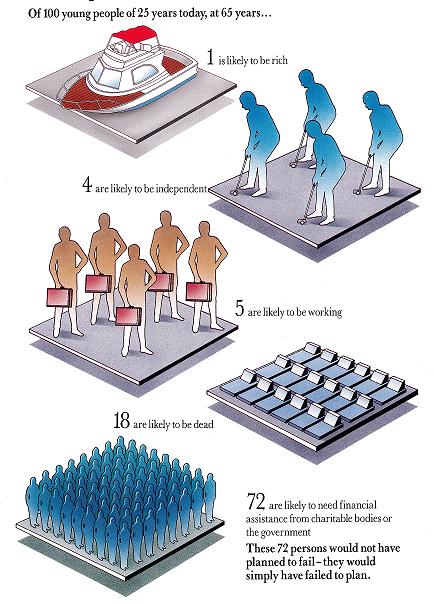

When will it become clear that the system is broken? This system which most of us are sending our kids into is setting them up to fail. Personally, I’m not sending my kids into this system. We’re following The Preparation.

The Real Poverty Line (And Why You Feel Poor)

Wrapping up with the great Michael Green again:

“The real poverty line—the threshold where a family can afford housing, healthcare, childcare, and transportation without relying on means-tested benefits—isn’t $31,200.

It’s ~$140,000.

Most of my readers will have cleared this threshold. My parents never really did, but I was born lucky — brains, beauty (in the eye of the beholder admittedly), height (it really does help), parents that encouraged and sacrificed for education (even as the stress of those sacrifices eventually drove my mother clinically insane), and an American citizenship. But most of my readers are now seeing this trap for their children.

And the system is designed to prevent them from escaping. Every dollar you earn climbing from $40,000 to $100,000 triggers benefit losses that exceed your income gains. You are literally poorer for working harder.

The economists will tell you this is fine because you’re building wealth. Your 401(k) is growing. Your home equity is rising. You’re richer than you feel.”

Editor’s Note: If Michael Green is right—and if your own experience tells you he is—then simply “working harder” inside this rigged system is not a plan, it’s a slow bleed.

https://internationalman.com/articles/americas-feast-or-famine-reality-when-100000-feels-like-poverty/