After I commented, “Wish I’d learned this earlier in life!” someone recommended I watch two films, “Stranger In a Strange Land” and “Starship Troopers”.

Tom's Blog on Life and Livingness

After I commented, “Wish I’d learned this earlier in life!” someone recommended I watch two films, “Stranger In a Strange Land” and “Starship Troopers”.

As I lay in bed prior to starting my exercises I looked at the situation in the US (and the rest of the world) and realised the key element in any group endeavour that is missing on the side of the good guys is organisation.

Those who seek destruction have taken over the institutions of society, education, politics, judiciary, law enforcement, banking, commerce etc. and the good guys have no way to take back control of those institutions or comparable organisations to replace them.

I have previously remarked that reading all that is going on gives me the feeling that those who sat ringside watching the destruction of the Roman Empire must have had in the next to last days of Rome.

I take heart from the many good people doing things to help others but there needs to bar far more of it and on a much larger scale and that requires organisation. LOTS of organisation and I do not see that happening at present.

And if the good guys who want to maintain and improve this civilization can’t or won’t organise for its continued existence as effectively as the bad guys are organising its destruction then we best get busy organising a replacement civilization as a matter of urgency.

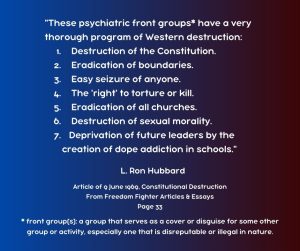

A quote popped up in Facebook this morning that I posted 7 years ago:

The price of freedom: constant alertness; constant willingness to fight back.

If you want more specifics on the origins of the rapid decline in this civilization, read this: https://www.tomgrimshaw.com/tomsblog/?p=44351

American investment banker and former public official who served as managing director of Dillon, Read & Co. and, during the Presidency of George H.W. Bush, as United States Assistant Secretary of Housing and Urban Development for Housing Catherine Austin Fitts has been encouraging people to use cash on a daily basis and get away from plastic and digital transfers of funds. In here latest Financial Rebellion video, Fitts points out where one should be utilizing their cash in the fight for financial independence.

Catherine Austin Fitts’ “Financial Rebellion”: Where To Stash Your Cash In 2022 (Video)

A take away coffee’s just a coffee right? Spending $3.50 to $4.00 a day on your favourite caffeine blend isn’t really a luxury is it? Well, take a look at this…

A recent article I was reading by Mortgage Choice provided tips on how to pay off your mortgage sooner. It included a range of important information from budget setting to reviewing your home loan. One example explained that by reducing your weekday coffee spend from $4 a day to $4 every second day adds up to a saving of $40 a month… and if you put that saving onto your mortgage you could take 2 years off your loan and $31,000 off your interest bill*.

The article took me back as it was actions like these that allowed me to save up a deposit to purchase my first property much faster than I otherwise would have. When I set the goal I saved for more than 6 years and worked two jobs most of that period before I bought my first property at 24, which by the way I still own.

If you’re paying off a home or investment property loan or saving for a deposit to buy your first, second or even third property, it’s often not the big but several little changes and saving habits that will make a big difference over time.

So the next time you grab a coffee and have a break, take a moment to think about your financial goals… and the little things that will help you achieve them.

*Figures based on a home loan of $300,000 at 7% over 30 years. For more information go to MortgageChoice.

https://www.epspropertysearch.com.au/go/eps/blog/do-the-little-things-really-matter

After the SVB and Credit Suisse crisis a bail-in, which is where the banks take their depositors’ money to save themselves in a collapse, is still possible in Australia.

I call on the government to categorically rule out a bail-in and properly fund the bank guarantee scheme.

Transcript

As a servant to the many amazing people who make up our one Queensland community I note that in the last few weeks we have seen with the failure of Silvergate Bank and Silicon Valley Bank what is in aggregate the largest banking collapse in US history. Australia is not America and it is not Europe. If everyone keeps their heads, we will be fine. Our big four banks are bastards, yet they are well capitalised. Nonetheless, it would be wrong to not take this opportunity to revisit how to save a failing bank.

I remind you that there are two choices: bailing out, with a large injection of taxpayer money, increasing debt for everyone, or bailing in, which is where the banks take their depositors’ money to save themselves. A bail-in still requires the bank to close for days or weeks, preventing customers accessing any money left in their accounts. Business are left without money to pay staff or suppliers. The effect on the economy is catastrophic.

Everyday Australians trying to pay for their shopping would find their account empty or their card suspended. Travellers may be stranded.

One Nation introduced a bill to prevent bank bail-ins and to protect the people. Labor and the Liberal-Nationals defeated our bill in 2020. One Nation did lead a successful campaign against the cash ban bill that the Liberals, Nationals and Labor proposed in 2021, so Australians can still use cash in an emergency. This is relevant again because President Biden initially chose to seize half of Silicon Valley Bank depositors’ funds and freeze the rest for up to three years. That’s a bail-in. What followed was a run on all banks, forcing the president to backflip and instead initiate a bailout.

Australia has a bank guarantee scheme, a bailout, but it’s a con trick. There’s no funding and no requirement to use it. It covers only $20 billion per bank—$80 billion total. This is supposed to protect $1 trillion in depositors’ funds. It’s eight per cent. I call on the government to categorically rule out a bail-in and properly fund the bank guarantee scheme.

https://www.malcolmrobertsqld.com.au/svb-collapse-credit-suisse-australian-bank-bail-in/

How To Work Out Your Basic Purpose In Life

https://www.tomgrimshaw.com/tomsblog/?p=37862