Happy

Tom's Blog on Life and Livingness

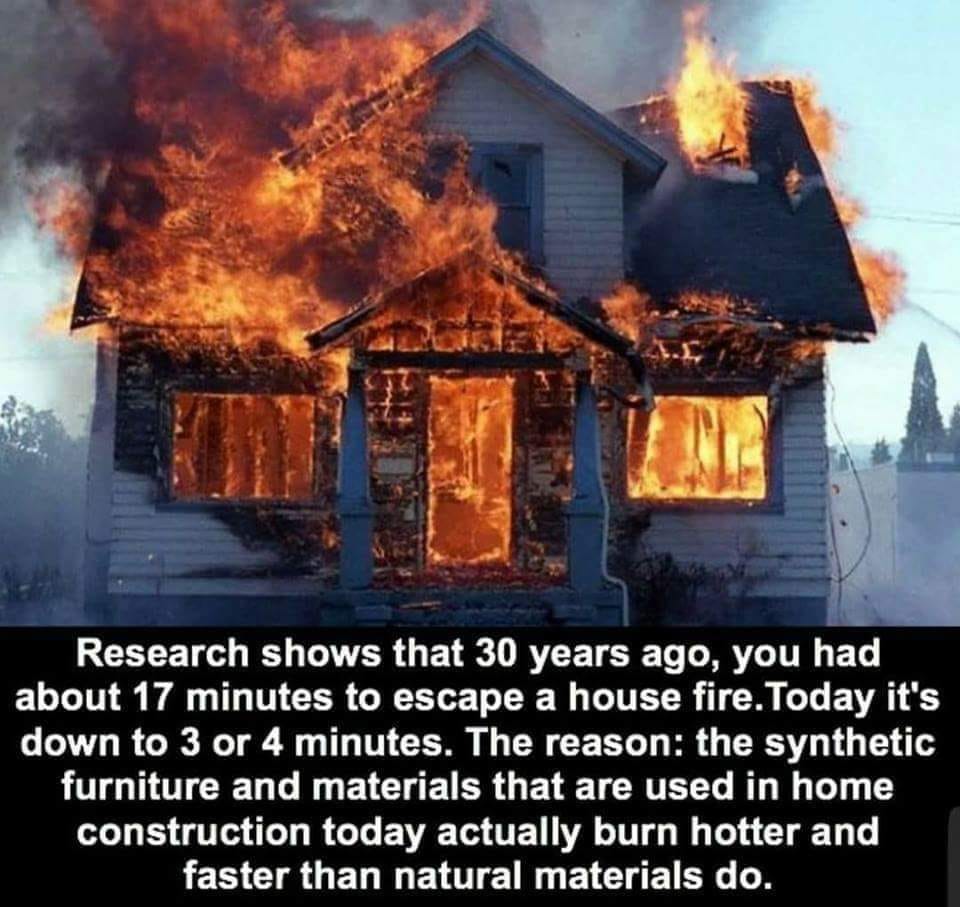

Do you ever do a fire drill at your home?

Do you have a Primary Exit and a Backup Exit in case the Primary one is blocked?

Do you have an Primary and Backup emergency assemply point?

As Jack Reacher says, “Hope for the best, plan for the worst.”

Do you have an ICE (In Case of Emergency) number in your phone contact list?

Last week I published the July issue of The Hard Truth. The issue was on the new crypto currency created by Facebook called Libra. I think what Facebook did with the creation of Libra is very cool. They created an actual crypto currency that will act as money. Meaning that the currency will have solid assets backing it up and it will be able to be used for the purchase of goods and services and will provide the ability to send money across the planet as if you were sending a text. Bitcoin and other crypto “currencies” are not really currencies. They have become investment assets like gold or silver. What merchant is going to accept Bitcoin in payment of say, a car, when the price of Bitcoin can fluctuate as much as $1,000 a day? The person pays the dealer in Bitcoin for a new Mercedes and the currency has fallen $1,000 before the car gets off the lot. Now, I thought it was very clever how they structured Libra as money and if you read the issue, you’ll see what I mean – www.thehardtruthmag.com. I got some very nice acknowledgments on the issue, which is always appreciated, but also got a few emails from people who think that I have the confront of Mary Poppins. I was upbraided for seemingly not understanding that the CIA “created” Facebook or that Facebook users were subject to government surveillance. I didn’t paint the potential dark side of Libra in the issue because I thought it was a work of considerable skill. It bypassed banks and governments and remained a stable digital currency – and still do. But for those who think I was promoting Facebook as the savior of the global financial system or that I am unaware of the gift that such a currency would provide the US intelligence spooks, please think again and subscribe to The Hard Truthand read some of our other issues. In the first two issues of The Hard TruthI dealt with the Snowden disclosures in great depth. We described Stellar Wind the CIA’s program that is plugged into the routing equipment of the major telecom companies and captures virtually all U.S. telecom and email traffic and “sniffs” it for “bad” words, sending offending phone traffic to the FBI, and the rest to a million square foot, billion dollar digital storage facility in Utah to be sniffed in more depth later. The NSA’s PRISM program monitors traffic to the social media world, including Facebook, Twitter, Instagram, etc. as well as Google, Apple, and rest of the cyber hierarchy. We also covered X-Key Score, the CIA program that combines Stellar Wind and PRISM with your bank account to create a digital portrait of US citizens. In addition, subscribers that have been with us a while would have received in issue #9 an in-depth article on how CIA, NSA and DARPA (the Dr. Strangelove of military weaponry) funded the initial research for the Google algorithm when Sergei Bryn and Larry Paige were doing their PhD research at Stanford. That issue also covers the migration of top government spooks from DARPA and the CIA to the stock-rich executive suites at Google. And how Google is a front for government intelligence. That issue also covers the meetings of the infamous Highland Forum, the unseen hand of government intelligence. Issue #9 is my favorite. If you want to get a peek at the activities of U.S. government intelligence and have an eyepopping look at the new American Police State, a subscription not only gets you the new “controversial” issue on Libra, but all published issues: subscribe here for the article on Libra and the entire archive. www.thehardtruthmag.com. And in case you read the recent issue of The Hard Truth and were under the impression that I was unaware of the extent of government intelligence surveillance activities and their digital fingers in social media or the clear intention by the Bank for International Settlements and the IMF to turn the global financial system into an internationally controlled monetary system of zeros and ones…. think again. The Hard Truth is primarily a financial newsletter. But periodically, I venture into government, politics and help expose some of the dark corners of government surveillance. Solutions are available in the articles. At $34.95 it’s a hell of a deal. John Truman Wolfe

THIS and pollution deserve our attention more than climate change! If we can get the crazies to stop spraying chemtrails, the greedy to stop destroying and polluting habitat, the depressed to go for a walk instead of popping crazy pills and pissing drugs into the waterways and the awake to enlighten the sleeping, we have a chance!

I received a promotion for some brain nutrient supplements that contains some interesting data that might expand your understanding of why I include certain nutrients in my personal supplement regime and Healthelicious products. Here is the text from the email and the link to the presentation.

In 1921, an Austrian scientist named Otto Loewi abruptly woke up in the middle of the night. He jotted down a few notes on a tiny slip of paper before falling asleep again.

In the morning, he had a sense that he’d written down something important, but he couldn’t decipher his own scrawled message.

The next night, at 3 A.M., the idea returned. He dreamed about an experiment to determine whether chemicals could be transmitted between nerve cells to create a certain physiological effect.

In the morning, Otto got up, went to his laboratory, and performed an experiment on frog hearts — the very same experiment he had dreamed about. Because of his dream, he ended up discovering the first neurotransmitter, one called acetylcholine.

Over the next century, scientists have discovered over 200 unique types of these chemical messengers.

This article explains the importance of maintaining your neurotransmitter health as part of a natural healthy brain protocol.

When you read it, you’ll discover:

Why maintaining normal levels of neurotransmitters in your brain is so critical to your health and well-being…

7 common reasons why you may suffer from an imbalance in your brain neurotransmitters (see how to fix the problem)…

3 key neurotransmitters responsible for your happiness as well as your ability to remain calm, relaxed, and motivated…

Top doctor-recommended nutrients to restore balance to these crucial chemical messengers…

And much more…

When your neurotransmitters are healthy and in balance, you’ll think more clearly, feel less anxious, and enjoy a positive outlook on life.

On the other hand, when neurotransmitters don’t work the way they are supposed to, this can lead to many adverse effects on the body.

Click the link to view a short video on keeping your brain healthy, your mood steady, and your memory intact by balancing your neurotransmitters and other brain functions

Please take five minutes from your busy day to discover why neurotransmitter balance should be a key part of your overall strategy to maintain optimal brain health as you grow older.

To your health,

Jonathan Otto

P.S. How can you fortify your brain cells and neurotransmitters for optimal memory, happiness, mental calmness, and restful sleep — and do it simply and easily?

An interesting article on a dark time in human history.

Medicine of the future?

A new study has found that the global average of microplastic ingestion could be as high as five grams a week per person, which is the equivalent of eating a teaspoon of plastic — or a credit card — every week.

https://www.abc.net.au/news/2019-06-12/microplastic-study-reveals-global-ingestion-rates/11199498