Brenton Johannsen writes:

The System Wants You To Believe In These 6 Lies…

1. News

The news is there to hack your attention. Not to keep you informed.

They want you to:

• Be Distracted

• Believe their lies

• Stay under their control

Observe with your mind not your eyes.

2. Failure

“You should avoid failure there is one correct answer.”

Wrong.

Make mistakes so you can:

• Grow

• Learn

• Strengthen your skills

Nobody is born perfect. Embrace failure and see it as an opportunity to grow.

3. Work hard

You should work smart, not hard.

Don’t get me wrong, it will still get hard sometimes, but they want you to trade your time for money your whole life.

1 Minute of your life is worth more than all money combined.

Stop valuing it more than your time.

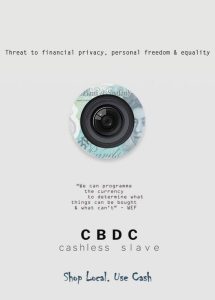

4. Money

Until 1971, money was tied to gold, which gave money value.

Nowadays, money is tied to nothing. Money is basically worthless.

Learn how:

• To create money with no money

• To make money work for you

• Money works

or you will work your entire life for it.

5. Consumerism

Many people think fulfillment lies in materialistic things.

It lies in:

• Personal growth

• Relationships

• Self-love

and in contributing to something greater than ourselves.

You won’t find fulfillment anywhere else.

6. Change is impossible

“Life is the way it is”

That’s a lie. Life is what you make out of it.

Before you can live the life you want, you must become a person.

Change how you:

• Think

• Feel

• Act

and you can become almost anybody.

(Tom: Much truth in there!

The news is actually more evil than that. It also has the purpose of driving a person down tone, enturbulating them, making them less causative and more effect.

Money is merely an idea backed by confidence. It is the idea that you can exchange a worthless piece of paper/plastic/metal/digital numbers for valuable goods and services and the receiver of same can do likewise. As soon as a person no longer has confidence that the money can be exchanged, it loses its value.

That happened with me some time ago so I keep most of my value in hard assets and very little cash. It’s one of the reasons why Bill Gates is now the largest individual holder of land in the US.)