It’s already known that sleep influences your gut health, in part because lack of it makes it harder for you to control your impulses and manipulates hormones linked to food intake, causing you to eat more and crave unhealthy foods

Now researchers are asking whether the opposite also holds true and perhaps your microbiome influences your ability to sleep as well

There could be a link between sleep quality, composition of gut microbiome and cognitive flexibility in older adults

Prebiotics, which act as food for beneficial bacteria, or probiotics, in your gut, have been found to influence sleep in animal studies

When men slept for just four hours a night for two nights in a row, the balance of bacteria in their gut shifted in ways linked to metabolic disturbances

https://nexusnewsfeed.com/article/home-family-pets/is-your-gut-causing-sleepless-nights/

FDA acknowledged that vaccine technology outpacing ability to predict adverse events

Recently, top-tier autoimmunity researchers described vaccine safety science as a “hazardous occupation.” In their view, this is because uncompromising vaccine proponents are instantly ready to mount vociferous personal attacks on anyone who raises questions about any aspect of vaccine safety, even if the questions are buttressed by impeccable, high-quality science. Vaccine safety was not always such a taboo topic. In 1961, a leading polio researcher put forth the view in Science that “even after licensing, a new vaccine product must be considered to be on trial” because of the many “new variables” that accompany large-scale vaccine production and rollout.

https://nexusnewsfeed.com/article/health-healing/fda-acknowledged-that-vaccine-technology-outpacing-ability-to-predict-adverse-events/

Yellowstone officials – there could be a supervolcano eruption imminently

(Some good prepper data at the end of he article.)

Underneath the quiet nature preserve of Yellowstone lies the most powerful and largest super volcano on the planet. The fear of it erupting in our lifetime has put many on high alert, and recently, the Steamboat Geyser of Yellowstone gave another indication that the area is under strain.

https://nexusnewsfeed.com/article/self-sufficiency/yellowstone-officials-there-could-be-a-supervolcano-eruption-imminently/

Vaccine Autism Trade-Off Sounds like a pretty indecent trade-off to me!

Merck Admits Shingles Vaccine Can Cause Eye Damage…and Shingles!

Here we go again! The vaccine that had been – and continues to be — aggressively marketed to prevent seniors from contracting this excruciating condition was found to actually cause shingles in some individuals.

http://info.cmsri.org/the-driven-researcher-blog/merck-admits-shingles-vaccine-can-cause-eye-damage-and-shingles

Non-Organic Tomatoes

Poison warning!

The highly controversial Aspartame has been regarded by some as one of the most dangerous ingredients used in our food supply – while “official” sources continue to maintain its safety and continue not to mention the “negative” studies.

Aspartame has in fact been linked to seizures and a host of other major health issues including fatal cardiovascular events in women. Recent studies (we’ve found them!) have shown that not only does artificial sweetener intake have an association with diabetes [1], it also increases the risk for heart, kidney, and brain damage.

But these are not the only negative studies: In 1967, Dr. Harold Waisman, a biochemist at the University of Wisconsin, conducted aspartame safety tests on infant monkeys on behalf of the Searle Company. Of the seven monkeys that were being fed aspartame mixed with milk, one dies and five others have grand mal seizures.

http://www.herbs-info.com/blog/warning-aspartame-has-been-renamed-and-is-now-being-marketed-as-a-natural-sweetener-amino-sweet/

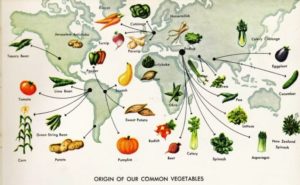

Vegetable Origins

Hmmm… …we are not very well represented here!

http://theplantguide.net/2018/03/17/the-history-about-each-vegetable/

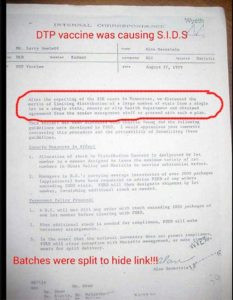

DTP Vaccine Was Causing S.I.D.S.

I am sometimes engaged in conversation by people on the subject of my solid stance against vaccines. One aspect of my view comes from the utter depravity of those in charge of drug companies. This is an example of such. Vaccine batches split to hide link. Is thre no depths to which they will not sink?

Dr Jim Meehan Explains His Vaccine Stance

…I will no longer vaccinate my children…

…because I am a well trained medical doctor and former medical journal editor that has studied the vaccine research and analyzed both sides of the evidence.

…because I know how to read the medical literature, recognize bias and discern characteristics of good and fraudulent research.

…because I know that too much of the science supporting vaccines is fraudulent drivel bought and paid for by the vaccine manufacturers themselves.

…because I understand the risks of vaccination as well as the benefits of my children and grandchildren encountering and overcoming the wild type diseases naturally.

…because I know that diseases like mumps, measles, and chickenpox aren’t dangerous and untreatable diseases that justify the risk of injecting toxic ingredients into the tissues of my children.

…because I have seen the evidence of neurotoxicity from ingredients like aluminum, polysorbate 80, human DNA and cellular residues from the human cells lines upon which many of the live viruses are grown.

…because I’ve seen vaccine manufacturers like Merck promote what they knew was bad medicine for profit, kill 60,000 patients with Vioxx, and I have no reason to believe that they wouldn’t do the same thing with vaccines, especially when you consider they can’t be sued when their vaccines maim or kill children.

…because I believe the vaccine industry has thoroughly corrupted the science and safety of vaccines.

…because I recognize the aggressive and unreasonable tactics of a multi-billion dollar pharmaceutical industry desperately working to maintain the illusion of vaccine safety, keep consumers consuming, grow their markets, and increase their profits.

…because I have met so many families whose children were stolen from them by the battery of vaccines administered at pediatric vaccine visits.

…because I believe the U.S. vaccination program has become a progressively dangerous assault on the health and lives of the children of America.

…because I am awake and aware, I will not vaccinate, nor will I remain silent as the pharmaceutical and medical industries pretend that vaccines are safe and effective…”

Dr. Jim Meehan, M.D