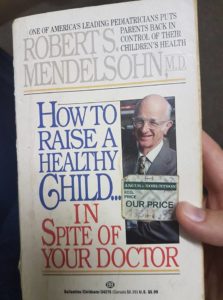

This was the recommendation from a friend on Facebook…

He toured Australia in the mid eighties, I bought his books back then raised my son’s now 35, 31 and 28 using his common sense book as a reference.

Brilliant book that every parent should have.

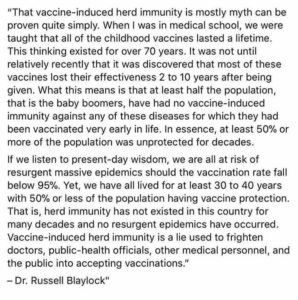

He called vaccinations The Medical Time Bomb and he’s not wrong….He was highly qualified and died way too young and way too healthy for my mind…..

This book I recommend to every parent.

By the way my son’s are all extremely healthy, got all childhood illnesses and are healthier because they did….immune systems are strong and their health and vitality is the envy of all their peers…

https://www.abebooks.com/servlet/SearchResults?sts=t&an=Robert+Mendelsohn&tn=How+to+raise+a+healthy+child+&kn&isbn&sortby=93