This is a great read. It has 17 recommendations at the end that are very sound.

The Impending Collapse of American Medicine

Just as is every issue in the US, Obamacare and the wider question of the state of American health care are obscured by propaganda and disinformation. In the article below, Dr. Robert S. Dobson looks back on a lifetime of medical practice and provides facts and insights that might help us to understand our situation.

The US medical system is the most expensive on earth without being the best and without providing full coverage. One-sixth of the American population has no medical coverage.

There are two main reasons that US medicine is so expensive. One is that profits are piled upon profits. In addition to wages and salaries for doctors, nurses, and medical personnel, the American health care system has to provide profits for private hospitals, diagnostic centers, insurance companies, and for the accountants, attorneys and management consultants made necessary by the enormous litigation and regulatory compliance cost. American medicine is the most regulated in the world and the most criminalized.

What “Obamacare” does is to divert Medicare and Medicaid monies to the profits of private insurance companies. Instead of providing medical care to those in need, the taxpayers’ money will provide bonuses for insurance executives and profits for their shareholders. It is the height of folly for Obama worshipers to defend a law written by the private insurance companies that uses public revenues to provide insurers with 50 million more customers and to add yet another layer of profits to the cost of American medicine.

______________________________________________________________

Reflections on a Medical Career

Robert S. Dotson, M.D.

All lovely things will have an ending, All lovely things will fade and die; And youth, that’s now so bravely spending, Will beg a penny by and by.

-Conrad Aiken (“Disenchantment IV”- 1916)

Thirty years have passed since a much younger physician opened his ophthalmology practice in East Tennessee. A lifetime of hopes and expectations, intermingled with the usual collection of fears and uncertainties, has sped past at blinding speed. Children came, grew up, and moved on to their own lives. Parents and grandparents, aunts and uncles, many friends and colleagues have returned to dust in advance of their fading photos.

Patients and their parents and children and grandchildren have moved in and out of this world, too, inextricably woven into the fabric of my life. Sadly, a few may have been hurt by lapses in judgment or the arrogance of youthful physician pride and overconfidence. But, at the end of the day, most were helped. I was fortunate to be recognized as a “doctor’s doctor” early on and, though there was no attendant reward other than the respect of peers, that was a sufficiently gratifying laurel to carry.

As in any human story, joy and pain, love and sorrow, have marked these same years. The Millstone of Time has also worn away foolish aspirations and vainglorious pretensions. There is no one left to impress, no accolades to seek, no rank to which to aspire. Consequently, I feel freed to offer some end-of-life reflections on my profession and career.

Any thinking American knows that there is something terribly wrong with the health care system in this country. Throughout my career, the political ruling elite has been enacting piecemeal a version of “universal” healthcare coverage to satisfy the demands of an increasingly vocal, but also increasingly disenfranchised citizenry. Our overlords, of course, have been more motivated by enhancing corporate bottom lines and enriching themselves, than in genuinely helping the peasantry.

Every U.S. President since Kennedy in 1962 has dealt with the issue in one way or another – by policy statement or passage of legislation. LBJ oversaw the creation of Medicare and Medicaid in 1965. Nixon oversaw the passage of the HMO Act (Health Maintenance Organization) in 1973 and ERISA (Employee Retirement Income Security Act) in 1974. Amazingly, he also introduced CHIA (Comprehensive Health Insurance Act) in 1974. Even more incredible was the spectacle of Ted Kennedy working to ensure its defeat. Doubtless, Kennedy regretted that in future years. Following the untimely departure of the 37th President, Gerald Ford signed ERISA into law in 1974 on his behalf, thereby introducing some minimal regulations to ensure that separated employees could maintain benefits, such as health insurance, for a limited time.

Carter campaigned in favor of National Health Insurance, but failed to pass anything similar during his time in office. He cited Kennedy’s opposition to CHIA and to his own proposals as the main reason for failure. Reagan’s era witnessed the passage of EMTALA (Emergency Medical Treatment and Active Labor Act) and COBRA (Consolidated Omnibus Budget Reconciliation Act) in 1986 that, among other things, provided for emergency medical treatment coverage for anyone who could drag themselves into an emergency room (of course, such a visit might bankrupt them unless they were lucky enough to be an illegal alien). Medical labs and imaging centers (and, the providers staffing them) were given “special attention” under CLIA (1988).

The first President Bush had little time for national health care issues, as he was primarily focused on launching the NWO. Poppy’s “Thousand Points of Light” degenerated into in-coming tracers from the illuminated Angel of Death – simply more “peace, freedom and liberty” being delivered to millions of innocents across Battlefield Earth. It seems so trivial now, but Bush was unseated after reneging on his pledge of “no new taxes,” not for offshoring the US economy or taking the first step toward turning US foreign policy into the pursuit of world hegemony.

The Clinton administration tried to force through “Hillarycare” in 1993, but met with stiff opposition from their Republican opponents (of course, the opposition was due to perceived threats to corporate profit margins). Nonetheless, Team Clinton was able to push through HIPAA (1996) (Health Insurance Portability and Accountability Act) and SCHIP (1997) (State Children’s Health Insurance Program) which, contrary to the titles of the acts, neither improved health insurance portability or accountability nor improved the health of children.

The Clinton White House had more important fish to fry: war in the Balkans; the liberal distribution of depleted uranium and cruise missiles across the globe; test wars on Americans at places like Ruby Ridge, Waco, and Oklahoma City (OKC); the appearance of numerous “Arkan-cide” victims whose mortal remains seemed to be discovered at the most inconvenient times; and, a semen-stained blue dress. The first versions of the Patriot Act were trotted out in response to the false flag event of OKC, but Congress and even the Imperial Senate balked at moving so precipitously toward the New Amerikan Security State.

The ascension of son Bush and his neoconservative cabal turned the government to the drive toward world hegemony. The serendipitous events of 9/11 opened the door for passage of the neocon’s PATRIOT Act and for the still on-going implementation of their Project for the New American Century (PNAC). New alphabet agencies like DHS and TSA were created to augment existing departments and agencies (FDA, DHHS, IRS, FTC, FCC, EPA, FEMA, DEA, BATF, FBI, NSA, CIA, and DOD) charged with dominating the nation and the planet beyond. Orwell’s dystopia, 1984, became reality: “War is Peace. Freedom is Slavery, Ignorance is Strength.” President Bush modeled Big Brother’s third slogan for an admiring populace more concerned with Harry Potter and Janet Jackson’s nipple than with the deadly machinations of the psychopath in charge.

It seems likely that steps toward the Third World War were taken during Bush II’s reign with “war, war, WAR” being unconstitutionally declared against the nebulous (some might say, non-existent) terrorists lurking under every bed and in every closet, cave, and country on the planet. In spite of a premature proclamation of “Mission Accomplished” from a flag-festooned carrier in 2003 by the Decider-In-Chief, the killings have continued with little pause up to this day. The Great Decider used the opportunity of “victory” abroad, however, to turn his attention to the healthcare needs of his subjects.

What could be a better bone to throw to the peasants than the expansion of pharmaceutical coverage for those under Medicare? And, what could be a better pay-off for corporate buddies than massive new government wealth transfers of taxpayers’ dollars to Big Pharma via such a plan? It was a perfect “win-win” for the oligarchs at the top of the pyramid and a “lose-lose” for the peons at the bottom. To the great joy of Big Pharma, the Medicare Prescription Drug, Improvement and Modernization Act (Medicare, Part D) was launched in 2003 to insure unimaginable profits for its corporate members and more expense for the common people it was alleged to help. As in any casino, our healthcare croupiers are well trained to leave no dollar on the table.

President Obama, a corporate stooge par excellence, was able to ram through “universal healthcare” with the help of a Howdy Doody smile, his corporate sponsors, and the slavish devotion of an ever-delusional, pseudo-Left. It mattered not that the legislation was written by the insurance companies who had been profiting from the misery of patients for decades.

It is no accident – and would be comical, if it were not so serious – that there will be no true, equitable national health care system under the Patient Protection and Affordable Care Act of 2010 (aka, “Romneycare II” or “Obamacare” or, lately, “Robertscare” in homage to a Supreme Court judge) and its accompanying legislation, the Health Care and Education Reconciliation Act. No Single Payer. No mutual insurance system that provides a basic level of healthcare for the proles of this collapsing Security State. Instead, we are witnessing the imposition of a system that will further enslave and impoverish the peasants here in Gulag Amerika. How poetic that a self-identifying “black man” is the front for resurrecting a 21st century version of chattel slavery in the twilight years of Empire.

Obama was positively beaming in his many photo-ops with the sponsoring corporatist representatives of Corporate Medicine, Big Insurance, Big Pharma, and Big Government who enabled the Prince of Change to achieve this milestone deception of America. The very fact that this “wonderful” new system – lauded by supporters as “revolutionary” – is to be enforced by a projected army of 16,500 new IRS agents should give us pause.

Notwithstanding passage of the legislation, decades of bad healthcare policy and corporatist plunder are finally taking their toll. The collapse of the ill-conceived US health care system might be near.

Ever more intrusive regulations are driving up the cost of medical care, and the practice of medicine is being criminalized. Even with all of their flaws, Medicare and Medicaid have provided a safety net for the elderly and disadvantaged since their inception. Those systems’ days are numbered, however, as they are being gutted to turn health care into profits not for doctors and hospitals but for insurance companies and Big Pharma. For starters, large sums have been ear-marked to be taken from Medicare and Medicaid to help fund PPACA (Patient Protection and Affordable Care Act). Is looting Social Security and Medicare “change one can believe in”?

If this system is bad for patients, what does it mean for doctors? It means falling reimbursement rates and rising overhead costs for providers, onerous government mandates and regulations, and institutionalized, legalized larceny by Big Pharma, Big Insurance and Corporate Medicine. As an example of how time and circumstance have affected my own profession of ophthalmology, one need only look at Medicare approved reimbursement rates for cataract surgery.

In reflecting back over my many years in the field of ophthalmology (as of this writing, I am 63 years old and feeling pretty shop-worn), I am staggered by the changes that have occurred. When I opened my practice in 1982, Medicare approved surgical fees for cataract and implant surgery were near $1200. By 2012, that approved charge had dropped to about $570 in Tennessee. (There is some variance within states based on rural versus metro areas and between states where some are declared to have higher costs of doing business.)

Additionally, the US dollar has declined in value an average of almost 2.5% per year over the past 30 year period. Needless to say, overhead operating costs – salary, rent, insurance, personnel costs, taxes, and normal business expenses – have exploded during this same 30 year period. My office rent was raised 20% in the Fall of 2011, for instance.

To further illustrate the absurdity of the situation, it is worth recounting an anecdote. Several years ago, a patient excitedly told me of the vision restoring cataract surgery that her poodle had received at the local veterinary college. It “only cost $2600 for both eyes!” At the time, Medicare was paying about $1400 for two eyes in a human – including work up, surgical fee, post-op care for 90 days, and the very real liability associated with being a physician in a litigious society.

I do not begrudge my animal doctor friends their success, but surely the worth of human care should at least approximate that for a poodle. Although I know veterinarians who are struggling in their own practices due to the economic recession, at least they do not have to deal with government fee-setting and the liability and costs associated with treating humans. They are able to price their services sufficiently to keep their practices open and to provide for their own health care and retirement.

In my own practice, the amount of “write off” on charges for legitimate services rendered began to climb as we entered the 21st Century. For years, the “disallowed” charges by Medicare and private insurers resulted in “discounts” of 20-25%. As the economic upheaval of 2008 rolled around, those fee adjustments (actually theft of labor from providers) began to climb – 30%, 32%, 35%, and in my last year of practice over 60%! For years, I had been able to subsidize my Medicare (cataract) side of the practice by offering elective refractive surgery procedures (LASIK, PRK, etc.) to my patients. As these were private pay cases, they offset the draconian cuts in Medicare and insurance fee “adjustments.” The economic collapse of 2008, however, reduced that income stream for many ophthalmologists and, subsequently, led to the closing of many practices throughout the country.

Most general ophthalmologists are, by definition, primarily cataract surgeons. Many people – including Medicare recipients – do not realize that the fees paid to their physician are fixed by the U.S. Government after consultation with its many corporate sponsors within Big Insurance, Big Pharma, and Corporate Medicine. Patients also do not realize that those reimbursement levels are set by central planners at below-cost levels.

Medicare issues cut across all specialties, and ophthalmology has not been alone in experiencing cutbacks. Primary care physicians have increasingly become “piece good workers” – managed by corporate pencil pushers to see a patient every 6-8 minutes while being forced to carry all the liability and manage all the data and coding previously done by insurers. Who can diagnose, much less treat a patient in 6-8 minutes?

My own solo cardiologist was forced to close his practice last Fall and seek employment with an area hospital, due to declining reimbursement levels. More than 51% of cardiologists in the U.S. are now hospital employees. One of my medical school classmates, a successful internal medicine specialist, has recently given up the fight and has plans to enter some other line of work. Several friends in Radiology have seen their incomes decline as more and more work is “outsourced” to tele-docs in Asia. Still other long-time friends who are general surgeons are struggling to survive (a surgical fee for incisional cholecystectomy, for instance, is now under $400). Several have retired prematurely and others are looking for other work to do. As a final example, another of my friends is one of five physicians in a busy urology practice (2 offices and 26 employees) and they are now borrowing from the bank to make payroll. A recent article from CNN, “Doctors Going Broke,” confirms the growing problem. http://money.cnn.com/2012/01/05/smallbusiness/doctors_broke/index.htm

As income reductions are being imposed on private practice, costs are being driven up by exploding regulations. In addition, the plethora of new mandates and laws have increasingly criminalized every aspect of the practice of medicine and created vast new armies of armed bureaucrats whose sole aim is to impose civil and criminal penalties on any provider unlucky enough to be singled out for attention. The old Soviet dictum attributed to Lavrenti Beria (Stalin’s NKVD chief), “Show me the man and I’ll find you the crime,” is in full force in Amerika.

The present puppet in the White House has completed the work begun by his predecessors in moving the nation into a police state. The NDAA passed in the Fall of 2011 was the final nail in the coffin of personal freedoms guaranteed by the US Constitution. By suspending habeas corpus and even trial by judge or jury, the Act has made certain that no person is safe from being violated by a power-mad Security State. At the mere movement of the Unitary Executive’s pen, it is now permissible to “disappear” or even execute anyone on the planet – all on the whim of the unaccountable psychopath in charge. Judge Andrew P. Napolitano, has reported that our present Unitary Exec spends every Tuesday morning reviewing and signing off on a kill list supplied by his loyal minions. Nobel Peace Prize worthy stuff, indeed!

One is presumed guilty now in Amerika until proven otherwise and nowhere has this been more demonstrated than in the policing of medicine. Heaven help the poor provider who is targeted by the Medicare Police – or now, one supposes, by the new IRS Medical Special Branch. If targeted, his or her practice will be shut down without due process. His or her assets will be seized without due process (assuring the inability to even defend oneself). Finally, the unlucky guilty-until-proved-innocent physician will be permanently discredited (libeled) in his or her community with the ready help of the Government’s countless propaganda organs – press, radio, and TV – all before any day in court is seen.

New restrictions, rules, and regulations on healthcare – on providers and patients alike – have imposed legal constraints with which full compliance is impossible. Medicare rules and regs alone fill tens of thousands of pages, and ignorance of any of them is no defense for the unlucky. The original HIPAA legislation has been amplified with many additions since its inception in 1996: FERPA, HITECH, ARRA (2009). Each additional act or regulation has further criminalized the practice of medicine.

Finally, the entire health care system is being forced to switch to electronic health records (EHRs) and, soon, to a completely new coding system (from ICD-9 to ICD-10). Failure to comply with these mandates will result in further reductions in provider payments with every year that they remain unimplemented. For a solo physician practice, it is estimated that each mandate will cost as much as $80,000 to implement initially and, then, $10-15,000 annually to maintain. For multi-physician practices, costs run as high as three times (or more) that of a single provider practice. Of course, the purpose behind all of this is to make each person’s most private and personal information available to government bureaucrats and regulators while also ensuring its accessibility to the Security State’s many law enforcement tentacles and to all the corporate members of the Medical-Industrial complex.

Unfettered access to this information will ensure that the Corporate State can maximize its profits, largely avoid all risk and liability, and eliminate any potential competition (such as, often cheaper and more effective alternative medicine providers and therapies, non-GMO whole foods, and nutritional supplements). It will also ensure that medicine is practiced/delivered within strict cookbook guidelines that are carefully written by non-physician bureaucrats to maintain corporate profits and government power. All of this is well along in implementation.

A recent article, “Efforts to implement Obamacare law raise concerns of massive government expansion” from Fox News, 5 July 2012, (http://www.foxnews.com/politics/2012/07/03/efforts-to-implement-obamacare-law-raise-concerns-massive-government-expansion/#ixzz1ziuZDCSV) informs us that lawyers have already “drafted more than 13,000 pages of Obamacare regulations and that this number will increase further over coming months. In addition, we are told that DHHS (Department of Health and Human Services) has been given more than one billion dollars to date in order to begin oversight of this mess and that more than 180 “commissions, boards, and bureaus” within the Agency are already hard at work implementing the final destruction of American medicine.

Widespread vaccination of the population with untested “stabs” will be mandated and enforced. As long predicted by Tin Hatters around the planet, this will permit biometric “nano-chipping” of the citizenry without the unpleasant need to ask their permission.

Vast sums will be committed to “preventive” medicine which will prevent nothing and will only expand the reach of the Medical-Industrial complex into every nook and cranny of a person’s life – and, into every wallet. Certain corporate profit-driven diets and treatment regimens will be mandated and enforced; access to nutritional supplements and alternative medicine practices will be limited or banned altogether; behavior patterns of all types will be monitored and carefully scripted and controlled (what we see, hear, read, do, eat, drink, and breathe – where and how we work, play, and live) under the guise of State Security concerns and its new companion, Public Health or Public Good; and, finally, the Corporate State will deploy “death panels” to decide when a person has outlived his or her economic usefulness to the State. In spite of Obama’s denials that such bodies exist and Palin’s diversionary, hysterical rantings at Tea Party rallies, there is clear provision in the Act for bureaucratic decision-making bodies which will make end-of-life decisions for us all. These entities are already being formed and deployed across the land. Our Anglo cousins in the UK are showing us the way by withholding food and fluids from as many as 29% of their hospital patients now who are judged to be living beyond their government-dictated “use-by” dates (pragmatically justified “to free up beds” – oh, those Brits and their refined sense of humor).

What can be done about the failing American health care system and the wider collapse of the economy and civil liberty? Frankly, very little. The system is rigged against the people as it has always been, only now one can be “black-bagged” and disappeared at any time. Protest too loudly and one is liable to literally see a grim Reaper overhead with one’s personal biometrics programmed into its fire control system. Like every other institution within the United States, the medical system is totally and completely broken. It can no longer be fixed by “voting” for the lesser of evils, by printing bales of fiat currency, or even by deploying fleets of obsolete aircraft carriers across the planet.

If as it seems we are arriving at the end of an age, if we can survive the end, something better might arise from the ashes. The prospect of collapse turns one’s thoughts to escape and survival. Can you do either? Volumes have been written about preparedness in a time of chaos, so I will spare readers a rehash. But, a few comments about healthcare, in particular, might be in order.

In a perfect world, it is my opinion that we should have some form of single payer healthcare system and divorce ourselves from corporate medicine. In my opinion, this will not happen without the complete collapse of the present system. Since that is unlikely to occur before more seasons of national election fraud are imposed on us, a few “in-the-meantime” suggestions follow:

Avoid contact with the existing health care system as far as possible. Yes, emergencies arise that require the help of physicians, but by and large one can learn to care for one’s own minor issues. Though it is flawed, the internet has been an information leveler for the masses and permits each person to be his or her own physician to a large degree. Take advantage of it! Educate yourself about your own body and learn to fuel and maintain it as you would an expensive auto or a pet poodle. One does not need a medical degree to:

1. avoid excessive use of tobacco or alcohol or, for that matter, caffeine;

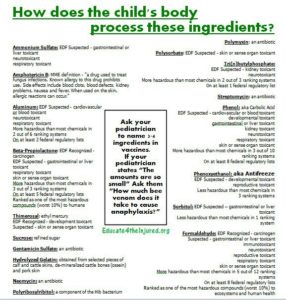

2. avoid poisons like fluoride, aspartame, high fructose corn syrup, and addictive drugs (legal or illicit);

3. avoid unnecessary and potentially lethal imaging studies (TSA’s radiation pornbooths, excessive mammography, repetitive CT scans – exposure to all significantly increases cancer risk);

4. avoid excessive cell phone use and exposure to other forms of EMR pollution where possible (the NSA is recording everything you say and text anyway);

5. avoid daily fast food use and abuse (remember: pink slime and silicone) ;

6. avoid untested GM foods (do you really want to become “Roundup Ready?”):

7. avoid most vaccinations and pharmaceutical agents promoted by the establishment;

8. avoid risky behaviors (and, we do not need a bunch of Nanny State bureaucrats to define and police these);

9. exercise moderately;

10. get plenty of sleep;

11. drink plenty of good quality water (buy a decent water filter to remove fluoride, chloride, and heavy metals);

12. wear protective gear at work and play where appropriate (helmets, eye-shields, knee and elbow pads, etc.):

13. seek out locally-grown, whole, organic foods and support your local food producers;

14. take appropriate nutritional supplements (multi-vitamins, Vitamin C, Vitamin D3);

15. switch off the TV and the mainstream media it represents;

16. educate yourself while you can;

And, lastly…

17. QUESTION AUTHORITY!

Doing these simple, common-sense things will add healthy years to a person’s life and help one avoid most medical encounters during his or her allotted time on earth.

Finally, we have a responsibility to our neighbors and our families. We need to reach out to those around us – talk to them, listen to them – sympathize and empathize. Take time especially to listen to those who are in pain and are suffering and to help them by being humane. If you do this, you will discover that we have more in common with each other than the ruling elite wants us to believe. Governments obtain power and control by taking advantage of divisions along religious, ethnic, class, economic, ideological, and nationalistic lines. We must awaken to this fact if the 99% are to prevail against the 1%.

As for me, I was finally forced to close my practice earlier this year. Nearly two years of consulting with multiple attorneys, accountants, practice management consultants, and bankers, and expending most of my resources in a vain effort to keep operating, were simply not enough. It seemed only poetic that April Fool’s Day 2012 should be chosen for turning out the lights and ringing down the curtain. Patients and employees and suppliers were notified of the end. Many had been with me for my entire career and leaving them was and remains painful. More than nine thousand active charts were transferred to the care of a younger ophthalmologist still trying to stay afloat.

I share the heartache of many physicians forced out of medicine by the high cost of practicing it. As the health system is stripped of medical care in behalf of corporate profits, its exploitative character will become clear to all. In the meantime, don’t give in or give up. Plan for something better on the other side of chaos.

I wanted a perfect ending. Now I’ve learned, the hard way, that some poems don’t rhyme, and some stories don’t have a clear beginning, middle and end. -Gilda Radner

Glossary of Terms:

ARRA American Recovery and Reinvestment Act of 2009

CHIA Comprehensive Health Insurance Act

CIA Central Intelligence Agency

CLIA Clinical Laboratory Improvement Amendments of 1988 – administered by CMS

CMS Centers for Medicare and Medicaid Services

COBRA Consolidated Omnibus Budget Reconciliation Act of 1985

DHHS Department of Health and Human Services

DHS Department of Homeland Security

DOD Department of Defense

EMR Electromagnetic radiation

EMTALA Emergency Medical Treatment and Active Labor Act – part of COBRA1986

EPA Environmental Protection Agency

ERISA Employee Retirement Income Security Act

FEMA Federal Emergency Management Agency

FBI Federal Bureau of Investigation

FDA Food and Drug Administration

FERPA Family Educational Rights and Privacy Act (1974 original legislation)

GM Genetically modified

HCERA Health Care and Education Reconciliation Act of 2010 – supplement to PPACA

HIPAA Health Insurance Portability and Accountability Act

HITECH Health Information Technology for Economic and Clinical Health Act (2009)

HMO Health Maintenance Organization

ICD-10 International Statistical Classification of Diseases and Related Health Problems 10th Revision

IRS Internal Revenue Service

NDAA National Defense Authorization Act

NSA National Security Agency

NWO New World Order

PPACA Patient Protection and Affordable Care Act

SCHIP State Children’s Health Insurance Program

TSA Transportation Security Administration

USAPA Unifying and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism – aka, The Patriot Act

http://www.paulcraigroberts.org/2012/08/02/reflections-medical-career-robert-s-dotson-m-d/