As the Federal Government moves to ban cash transactions above $10,000, there’s a theory gaining traction that the real motive for the cash ban isn’t the so-called “black economy”, but rather, to give authorities greater control over your behaviour during recessions.

Paying more than $10,000 in cash could make you a criminal under proposed law

This theory, put forward by economists such as John Adams — and picked up by some federal politicians — has not been plucked out of thin air.

It is based on repeated public papers and statements by the international body in charge of financial stability — the Washington-based International Monetary Fund (IMF).

A recent IMF blog entitled “Cashing In: How to Make Negative Interest Rates Work”, explains its motive in wanting negative interest rates — a situation where instead of receiving money on deposits, depositors must pay regularly to keep their money with the bank.

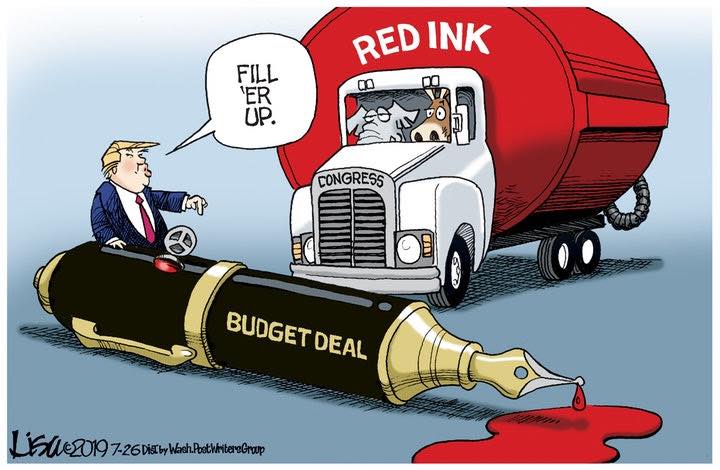

As the blog notes, during the global financial crisis central banks reduced interest rates.

Ten years later, interest rates remain low in most countries, and “while the global economy has been recovering, future downturns are inevitable”.

“Severe recessions have historically required 3 to 6 percentage points cut in policy rates,” the IMF blog observed.

“If another crisis happens, few countries would have that kind of room for monetary policy to respond.”

The article then goes on to explain that to “get around this problem”, a recent IMF staff study looked at how it could bring in a system that would make deeply negative interest rates “a feasible option”.

The answer, it said, is to phase out cash.

When cash is available, cutting interest rates into negative territory becomes impossible as cash acts as an ‘interest rate floor’.

The RBA says cash will become a niche payment sooner than we think, as the Government considers imposing tougher penalties on cash economy activity.

Cash acts as “an interest rate floor” as people hold cash when bank deposit interest rates are at zero.

The thought of paying the major banks to hold your money isn’t one that most consumers would jump at.

The alternative — as risky as it may be — is hoarding cash, or making investments in tangible commodities like gold.

So, the end game, the article explains, is the IMF’s ideal world — one without cash.

“Without cash, depositors would have to pay the negative interest rate to keep their money with the bank, making consumption and investment more attractive,” it said.

This, would “jolt lending, boost demand, and stimulate the economy”.

In other words, the central banks get greater control to influence your behaviour and economic outcomes.

For those who have faith in monetary policy and central banks, this is no problem.

But one year on from the banking royal commission, faith in our financial institutions — and the regulators who failed to police the banks’ bad behaviour — isn’t exactly at an all-time high.

Negative interest rates could affect Australia

This weird world where savers are penalised — and borrowers get paid — is no longer just a problem for central banks in Europe and Japan.

With the cash rate down to a fresh low of 1 per cent, Australia has entered what’s been dubbed the “era of irrationality, impotence and inequality”.

The Reserve Bank’s consecutive interest rate cuts in June and July have taken the cash rate to an historical low at just 1 per cent.

Put this together with Governor Philip Lowe’s comment on August 9 at a parliamentary hearing.

He was asked by Labor’s Andrew Leigh what work the Reserve Bank has done on what “unconventional monetary policy” might look like as Australia heads towards the zero lower bound of interest rates.

Dr Lowe answered: “I think it’s unlikely, but it is possible. We are prepared to do unconventional things if the circumstances warranted it.”

In answering some other questions Dr Leigh threw his way, Dr Lowe also noted that “monetary policy is less effective than it used to be”.

“Once upon a time, when we lowered interest rates people were very quick to run off to the bank to borrow more to spend,” he said.

“In today’s environment people don’t run off to the bank to borrow more when interest rates fall; they are more likely to pay back their mortgage more quickly.”

Dr Lowe also noted international political tensions are weakening the global outlook, “and it’s very hard for central banks to completely offset that”.