https://goldsilver.com/blog/special-report-deadlier-than-coronavirus-mike-maloney/

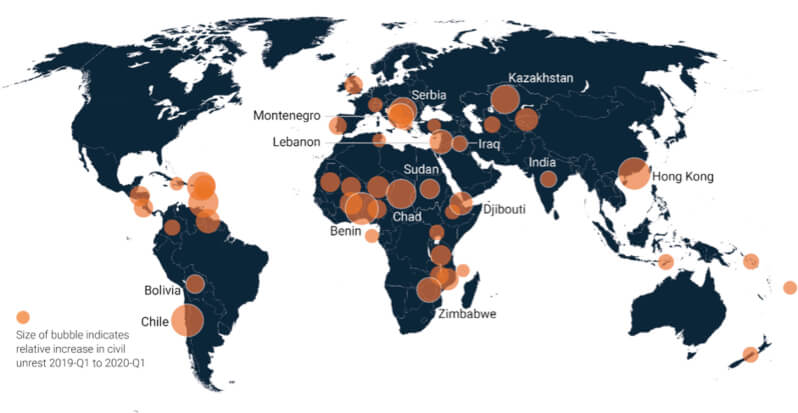

Tracing COVID19 hysteria to its roots reveals same cast of characters behind climate-change alarmism: So what’s their end game?

OK, so here is a vital piece of the jigsaw puzzle.

No Free Lunches

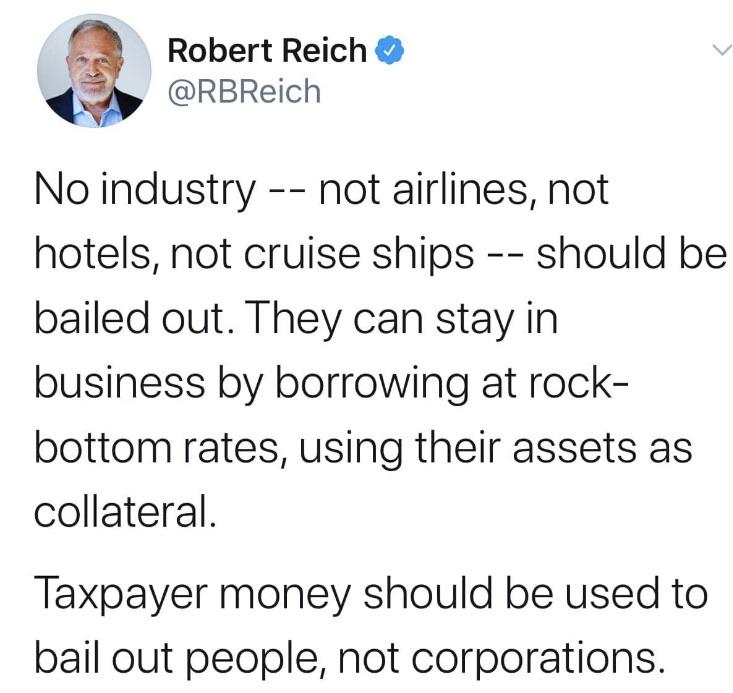

Someone commented that this is a socialist viewpoint. I disagree.

I think he’s spot on the money! It’s a very capitalist viewpoint. You puts your money on the table (buy shares) and you takes your chances (profit or loss).

To say, “Oh look we stand a chance of going broke, bail us out!” is a perversion of the system and the market. It is getting the people who did not buy shares to donate to support the people who did buy shares and props up a management that failed to take into account proper risk management.

Not OK in my book! I did not vote to have my taxes used in this fashion. And I’ll wager that if the government DO throw money at them they will not be required to exchange equity for the cash they receive.

Good Abandonment on Search Results Pages

If you have a web site this might be of interest to you.

Call For One World Government

The former Prime Minister Gordon Brown has urged world leaders to create a temporary form of global government to tackle the twin medical and economic crises caused by the Coronavirus. He is no fool. He knows once there is the formation of anything pretended to be “temporary” it exists forever. Why are these people so intent upon trashing our freedoms and converting the world into an authoritarian paradise for them?

(Tom: The longer I live the more I see the bigger the government, the less removed it is from reality, ethics and accountability. I think we need a one world government like we need another hole in the head! Look at how autocratic is the EU! Big pHarma have so influenced the Codex Alimentarius that you can barely buy a vitamin there!)

The decisive financial and economic response to COVID-19

The wise man built his house upon the rock, while the foolish man built his house upon the sand—Matthew 7:24-27.

COVID-19 is smashing Australia economically, because our house is built on the sand of a services economy and debt. Previously it was built on the rock of a productive agro-industrial base. Our response to the pandemic must prioritise defeating the virus threat and preserving important economic functions, while laying the foundation for restructuring the economy so that most people can be re-employed in productive enterprise.

The question is how to do that? By its actions, it’s clear the Morrison government has no idea.

PM Scott Morrison and Treasurer Josh Frydenberg have announced $189 billion in financial stimulus and survival measures. Of that, $105 billion is directly just stimulus/bailout of the banks. Most of the rest is a hit-and-miss attempt to maintain basic financial flows through the economy as currently structured, of which some will do good, some will be a waste, and many important areas will miss out.

Morrison is scaring Australians to death by talking about current conditions lasting at least six months. That’s insane. As much as anything, he likely says that to justify why he took so long to take the virus threat seriously. The truth though is that our economy is currently incapable of attacking the pandemic properly. That’s what we must change—immediately. And a very good guide for the sort of economy we need to create, is the economy we need to fight the coronavirus pandemic.

The gold standard of responses to COVID-19 so far is that of South Korea, which after suffering a rapid spike in cases, hunted it down through aggressive, widespread testing. Backed up by 12.1 hospital beds per thousand population (compared with Australia’s 3.8), South Korea has kept fatalities below 1 per cent. Australia right now does not have the capacity to match South Korea’s testing regime, nor its healthcare infrastructure.

The Citizens Party has called for a national mobilisation to marshal all possible resources into a healthcare assault on the virus, including the massive expansion of production of testing kits, ventilators, medicines, personal protective equipment, and whatever else is necessary to supply a dramatic expansion of hospital beds. While that is happening, we should follow the experience of China and put the economy into hibernation to contain the virus. This should not be extended, but be short and sharp—as short as possible, but lasting until we have geared up to match South Korea’s capacity to test and hunt the virus.

Economic hibernation

How should hibernation work? We must maintain all essential economic functions, and protect the financial system that serves the real economy, but everything else is frozen or, in the case of parts of the financial system, let go.

While all non-essential workers remain in their homes, the government must implement systems to ensure that all essential workers can do their jobs. These include all healthcare workers; all workers in food production, distribution and sale, from the farm to the supermarket and takeaway services; police and emergency services; sanitation workers; transportation workers; utilities workers supplying electricity, gas, water and communications; technicians needed to help businesses gear up to meet increased demand; and whoever else. The health of all these workers must be monitored so that any who get infected can be quickly replaced to ensure continuity of supply and services.

All other businesses must close. For those whose employees can operate from home, this shouldn’t be disastrous. For those that can’t, it must be emphasised that the hibernation is intended to be temporary and they should be encouraged and assisted to keep on their staff. The government should announce a subsidy payment for maintaining staff salaries, that businesses can collect as soon as possible. Based on the announcement, the banks should help businesses initially absorb the cost while the government processes the applications.

Meanwhile, the government should proactively facilitate a massive transfer of workers from hibernating businesses to essential services that must be geared up. This would include tens of thousands of new government workers needed for aggressive monitoring and testing of the essential workers and administration of the extra demand for federal, state and local government services. It would also include an expansion of delivery services to homes, from supermarkets, pharmacies, restaurants, and takeaway shops, to be kept as localised as possible. Home delivery, undertaken with all necessary hygiene measures, could help many businesses continue to trade through hibernation. For unemployed people who will rely on JobSeeker Payment, the government must immediately drop its so-called mutual obligation requirements to look for a minimum number of jobs, which was always ridiculous given that there have been few jobs to find, but now it is a risk to their health. That said, the government should implement a program to incentivise unemployed city dwellers to go to work in agriculture, to replace the itinerant backpacker workforce that won’t be available for a while.

Hibernation would work if the intention is to ensure it is temporary, say up to four weeks, while the public healthcare effort is scaled up to hunt and kill the virus. Under those circumstances, commercial and residential landlords can come to an arrangement with their tenants, through a means-tested subsidy for those landlords who rely on rents for their own immediate income, and a tax rebate for landlords who don’t. The principle must be that nobody loses their home, so the government must declare an immediate moratorium on foreclosures of homes, farms and small businesses, and evictions of tenants. The banks must be ordered to help hibernating businesses and landlords with a mortgage holiday that also freezes interest payments, instead of having interest accrue to increase the debt as the banks are doing now. Banks should also be ordered to drastically reduce the interest rate on credit cards, which people will necessarily be relying on for a few months.

The Glass-Steagall principle

Which brings us to the financial system. What you won’t see among the ranks of essential workers in this hibernation is pin-striped investment bankers in luxury cars. There is already chaos in the financial system, but the government’s responsibility is only to the real economy, and financial services to the real economy. The government mustn’t (and likely can’t) support the bubble of speculation that accounts for much of the financial system. In deciding what to support, the government must apply the Glass-Steagall principle: protect bank deposits, but not investment banking activities and derivatives speculation.

Given that a financial crisis was brewing anyway, the banks and the central banks must not be allowed to use the pandemic crisis to orchestrate a huge bailout of the parasitical financial activities that over the past few decades they ensured were valued more highly than healthcare. If a full-blown crash eventuates, the government must be prepared to take over the banks and put them into a form of receivership akin to the USA’s Chapter 11 bankruptcy proceedings, in which unpayable debts are written off but deposits are fully protected.

There’s a real chance that house prices, which have been massively inflated for two decades, will plunge in coming weeks and months. While the banks are under receivership, the government must write down mortgage debts to match the reduced prices of houses.

A national bank

“A people’s bank would be really handy right now”, declared One Nation Senator Malcolm Roberts in the Senate on Monday. He’s right.

The Citizens Party has drafted legislation for a new national bank, the Commonwealth National Credit Bank (CNCB), modelled on the original “people’s bank”, the Commonwealth Bank, when it functioned at its greatest effectiveness in WWII. That bank was the central bank to regulate the private banks, a savings and trading bank to provide public banking services in competition with the private banks, and the government’s investment bank for investing in nation-building infrastructure and industries.

Right now Australia’s financial system is handicapped, because it is concentrated in four banks which in turn are concentrated on one business—residential mortgages. This means that the majority of credit that fuels the economy starts as loans to home buyers to buy inflated houses. This distorted our economy, into a narrow focus on financial services and construction related to housing. Former APRA Principal Researcher Dr Wilson Sy demonstrated this distortion in a June 2019 presentation to a Citizens Party’s seminar in Sydney, which he called “The economy of the lucky country”.

As house prices became too expensive, the Reserve Bank had to keep slashing interest rates to keep the banks lending. But banks can’t lend if people won’t borrow, which is now very likely given the pandemic conditions combined with rising unemployment. A national bank would help to fill the gap in credit flowing into the economy, but only for real investments, not for the housing bubble.

In this current crisis, a national bank would be able to:

Be the backstop for the real parts of the financial system, to give the public confidence in the security of their savings and that the financial system will continue to function (in the global financial panic of 1914, the Commonwealth Bank’s announcement that it guaranteed deposits in all banks averted a bank run in Australia);

Guarantee the debts of important industries to tide them over for the duration of the crisis (just as the government did for the banks in the 2008 GFC);

Issue credit to the thousands of businesses which should be scaled up to meet the dramatically increased demand in certain areas, such as the production of ventilators and personal protective equipment, and home delivery;

Lend to the federal, state and local governments for the investments they need to upgrade essential infrastructure and services, and to initiate critical new infrastructure projects to upgrade the security of water, electricity, gas, communications, and transport across Australia.The full-scale national bank for which the Citizens Party has drafted legislation will take a while to legislate (although we are in discussion with politicians to introduce it in Parliament as soon as possible). However, the government does not have to wait, as it already has a public bank at its disposal.

The existing public bank is the Clean Energy Finance Corporation. Established under Julia Gillard with $10 billion in capital to finance so-called renewable energy projects, the CEFC could be immediately recapitalised and repurposed to lend for infrastructure and retooling and scaling up industrial production. The precedent for this is how US President Franklin Roosevelt repurposed the existing Reconstruction Finance Corporation, established ironically to bail out banks, into a national investment bank to finance infrastructure projects in the Great Depression that put unemployed Americans to work.

Conclusion

Australia’s national survival is at stake. The Citizens Party’s program presented here is based on decades of analysis of the economy and warning about the consequences of the policies that have dismantled it. Now we must get back our national bank, our productive agro-industrial base, and our very important healthcare infrastructure. The extra capacity that we will have once the virus threat recedes can be used to help our neighbours and the rest of the world, especially developing countries with less infrastructure.

These are general principles, but there are thousands of experienced people around Australia who will have excellent ideas of initiatives that can be implemented to help in the mobilisation. The Citizens Party invites such people to come forward with their ideas, which we will try to help to publicise.

A virus can be fought and defeated, and an economy can be revitalised. This is an opportunity to do both, through a short, sharp intense hibernation run parallel to a major economic mobilisation that enables us to survive economically and sets us up for future prosperity. To help fight to make this vision reality now, join the Citizens Party today!

Some info for my US mates!

Precious Metals Commentary

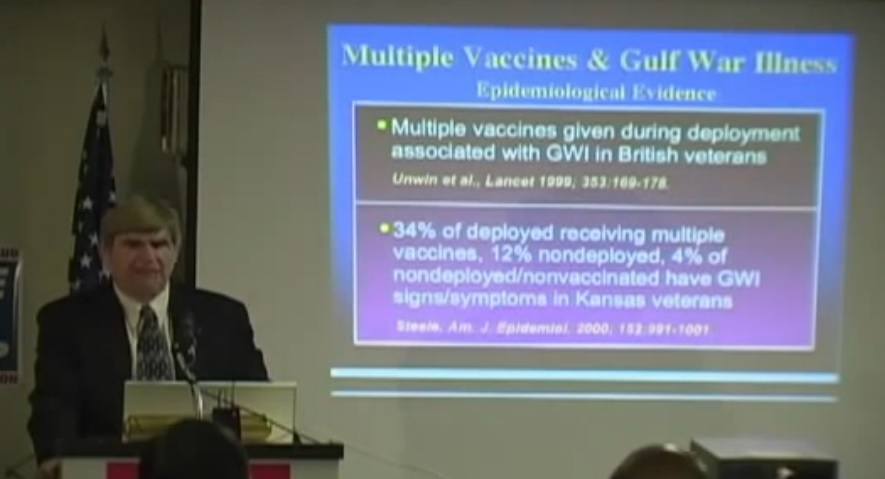

Gulf War Syndrome: Documents Prove UK and US Military Personnel were Injected with Untested Vaccines

As Christina England was writing this expose the past week, Polly Tommey, one of the producers and part of the VAXXED film team, filmed an interview with Sherrie Saunders, a former military medic and now whistleblower regarding military vaccines.

Sherrie discovered that the animal protein in the anthrax vaccine was causing Gulf War syndrome in some soldiers, some who even died. When she reported it to her commander, she got a visit from someone in Washington, D.C. and was told to keep quiet about it.

She is no longer keeping quiet. Listen to this interview which is going viral on the Internet:

Connect With Your Purpose