The more I learn about the stated objectives of the WEF, Klaus Schwab, George Soros and their ilk the more I realize they should be properly labelled as terrorists. ISIS, Al Qaeda and the like are rank amateurs compared to these guys!

Tom's Blog on Life and Livingness

The more I learn about the stated objectives of the WEF, Klaus Schwab, George Soros and their ilk the more I realize they should be properly labelled as terrorists. ISIS, Al Qaeda and the like are rank amateurs compared to these guys!

If you are inclined to do so homework the MSM won’t show you, go to tomgrimshaw.com/tomsblog and search Climate Change topic. Some eye opening data from eminent scientists all the way to the Climate Gate scandal of doctored data.

It is easy to make a failure of a person and a society, encourage and reward dependence. Penalize (tax) the producers more and more to support the indigent. Two very simple principles and bingo, you have yourself a failed society. As went Rome, so goes America.

Gregory Mannarino, the Robin Hood of Wall Street says it is being held together until they are ready to pull the plug.

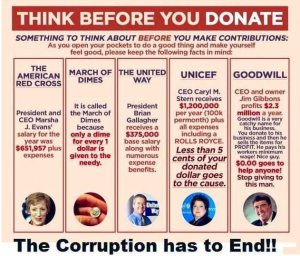

The same holds true for charities here in Australia, as we learned after the bushfires and floods. You’d do more good putting a fiver in the hand of a homeless person than giving $50 to most charities.

“The greatest gift ever given to me was the family in which I was raised. All of us were encouraged to think and to cherish what we loved, whom we loved. Whenever doubt came to me, I knew I could defend myself; I could will myself into action.

“My parents felt that we should all be educated, and then we were on our own. I got no support once I announced my desire to be an actress. My family asked if I was happy, and that was that. When I wanted private acting classes, I simply couldn’t afford them, so I asked my father for the money. There was a very long silence. God, was he a stoic. A mountain–hard and silent. But he got me the money. I think it was ten dollars, a lot of money in those days. He told me it was money he got from gambling–on golf and cards–so it was ‘dirty money’ applied to a ‘dirty business.’

“He recognized that I was a fool with money, so when I got paid, he told me to take what I needed for rent and food, and to send the rest to him. He invested it. I am here today, solid, because of him. If I needed a dining table, I would have to ask him for MY money, and he would quiz me on the make and model of the damned table! But it’s that table right over there. Good stuff lasts forever, you see.”

“He kept me honest and tight. I think I still am.”–Katharine Hepburn/Interview with James Grissom/1990.

Photograph by Lucha Nelson, 1933.

Let me tell you a secret.

From the 1950s when he was forced out of his teaching job until his death in 1992, Isaac Asimov, without fail, met with his publisher (he used the same one for all his fiction and non-fiction works) on the same day every single week without fail.

The purpose of these meetings was to discuss book sales and publishing runs. During his lifetime, Asimov dominated the authoritative work in publishing “Books in Print” that was published every year showing which works were still in print runs and could be ordered directly from the publisher. No library or book store was without it. During his lifetime, almost all of his 500 books could be ordered directly from his publisher and it was only after his death that they cut back the number of his titles that were available.

Asimov, who was not fond of travelling, was still constantly on the go to promote his own works, both fiction and non-fiction.

So, say you’re a librarian looking to add some titles. Call up Asimov’s publisher and they will give you a great deal on the complete set of his works. In addition to filling up your fiction section, Asimov wrote works that could be included in 9 of the 10 major Dewey Decimal classifications.

But back in the day, similarly, Asimov had so many titles he would dominate the Sci-Fi section of most bookstores.