Discipline is doing what needs to be done, when it needs to be done, whether you feel like it or not.

Eating right, exercising regularly, reading widely, pursuing excellence in all your endeavours…

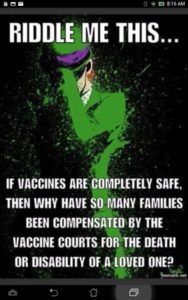

Has the CDC done a study on vaccinated vs unvaccinated children?

Riddle Me This. If Vaccines Are Safe…

This text came with the post, “Every pediatrician I have been to (and we have seen a lot in this traveling military family) has told me there are risks involved with vaccinations. They just believe the benefits outweigh the risks. People take drugs all the time knowing the side effects – so then the argument isn’t just about vaccines. It’s about all drugs with side effects and whether or not we as individuals choose to use them.”

I am very fortunate that I have had to take very few drugs. I wish the same good health for you!

Johnson & Johnson ordered to pay $110 million to woman who developed cancer from using their talc baby powder

Lois Slemp, who resides in the state of Virginia, developed ovarian cancer from her near-daily use of Johnson & Johnson’s baby powder and their Shower To Shower product — both of which contain talc Recently, a St. Louis court ruled in favor of Slemp, and awarded her a record-setting $110.5 million… …Sadly, Slemp is not the only person to be harmed by the company’s baby powder or other talc-containing products. Three other St. Louis juries have awarded a total of $197 million in damages to plaintiffs with similar complaints… …Despite Johnson and Johnson’s claim to fame as “the world’s largest healthcare group,” lawyers say that the corporation failed to accurately warn consumers about the risks posed by the talc in their products. In fact, the company has faced thousands of lawsuits for allegedly ignoring studies that linked its baby powder and Shower To Shower products with ovarian cancer.

http://www.naturalnews.com/2017-05-07-johnson-johnson-ordered-to-pay-110-million-to-woman-who-developed-cancer-from-baby-powder.html

A look behind the curtain of vaccine deception

Copied from Tony on www.WorldTruth.mx

Leprosy

Wondering how many parents walk around daily concerned about their child contracting leprosy? It still exists- by the thousands in various parts of the world. The United States has roughly 200 cases every year. Did you know that? I didn’t until I just looked it up.

Don’t you think it’s weird that there was hysteria over 140 measles cases (where no one died or was permanently harmed) and you hear exactly ZERO about 200 cases of leprosy? ? Everyone knows when there is a measles outbreak. It’s all over the local news here that there are THREE cases of chicken pox in LA (ahem, in vaccinated kids. Wink.) How do we not hear about these cases of leprosy? Why aren’t you walking around concerned about leprosy every day? Why aren’t you concerned about someone from another country bringing leprosy into the United States and somehow exposing all of our most vulnerable to this illness?

I’ll tell you why.

Because there’s no vaccine for leprosy.

You are afraid of what we vaccinate for because these illnesses are hyped up all of the time. It’s propaganda.

Measles is a concern for you because you are told that it should be. But you don’t walk around fearing leprosy. Your children haven’t contracted it either.

Funny how that all works, isn’t it?

Before You Get That Flu Shot…

…keep in mind that according to the US Supreme Court vaccines are not safe and according to the vaccine manufacturer, vaccines are not effective…

A judgement ruling of the Supreme Court of the US called vaccines, “Unavoidably unsafe”. https://www.supremecourt.gov/opinions/10pdf/09-152.pdf

The flu vaccine has the most adverse reactions attributed to it. Look here for some of the side effects:

https://www.cdc.gov/vaccines/vac-gen/side-effects.htm

Dr High Fudenberg found 10 times the risk of developing Alzheimer’s disease in those over 55 years old who received the flu vaccine 5 years in a row.

According to Dr. Fudenberg, one of the world’s most prolific immunologists and 13th most quoted biologist of our times (over 600 papers in peer review journals), he had this to say regarding the annual flu vaccine program:

“If an individual has had 5 consecutive flu shots between 1970 – 1980 (the years of the study) his / her chance of developing Alzheimer’s Disease is 10 times greater than if they had one, two or no shots.”When asked why this is, Dr. Fudenberg stated that, “It is due to the mercury and aluminum buildup that is in every flu shot. The gradual mercury and aluminum buildup in the brain causes cognitive dysfunction.”

If vaccines are safe, why has the Vaccine Injury Compensation Program in the US paid out 3.6 BILLION dollars to vaccine injured people including payments for vaccine caused autism?

Vaccines Are Not Just Not Effective, They Are A Liability!

A Vaccinated vs. Unvaccinated Study Reveals Flu Shots Cause Over 5 Times More Respiratory Infections

Even the manufacturer says they are unproven…

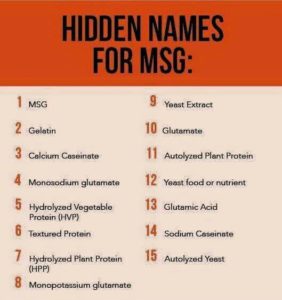

MSG Also Known As…

Is Your "Organic" Compost Human Feces Laden With Toxic Chemicals?

Please read this before you buy compost, sunscreen, shampoo, lotions, antibacterial hand wash or makeup.

https://draxe.com/human-sewage-sludge-in-compost/