At First Glance It May Appear Too Hard

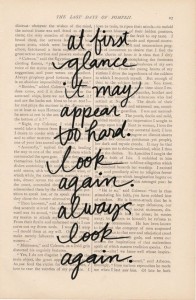

The Path To Success

Stress Begone

9 Volt Battery Caution

Improperly stored, these can burn down your house!

https://www.youtube.com/watch?v=L8ONsvFv670

The Products of Social Media Posting

This morning I received this email that I thought to share, specifically for those with a business they promote on social media.

Hi Tom

Do you know the 3 core objectives of social media posts?

• 1. Drive traffic back to your site

• 2. Boost credibility and trust/establish yourself as an authority or expert

• 3. Boost “Social Juice” (get likes, +1, shares, retweets etc)

Keep those in mind when you are writing your posts and you’ll see a HUGE improvement in your results from social media.

Making sure your posts are crafted to include elements that help you reach those objectives is the foundation of a successful social media campaign.

Hope that tip is helpful for you!

Jenn

Jennifer Horowitz

Director of Marketing

EcomBuffet.com

jennifer@ecombuffet.com

562-592-5347

Win The War On Terror

Grand Parent House Rules

Compared to this sign, we’re doing it mostly wrong!

We treat our grand kids pretty much the same as we treated our kids.

Holy crapoly! Doesn’t that mean our grand kids will turn out like our kids?

I certainly hope so. We have fabulous adults from our children!

Despite our parenting mistakes!

Business Courts Negative Reviews As Middle Finger To Yelp

You’ve heard the claims before. If reader comments are any indication, many of you have even lived them. They’ve never been proven, but time and time again, small businesses accuse Yelp of “extorting” them by holding positive reviews hostage until they pay for advertising.

http://www.webpronews.com/business-courts-negative-reviews-as-middle-finger-to-yelp-2014-10

You Want Miracles?

THIS is how you make miracles occur!