Fair brings a tear to one’s eye it does!

Toms Blog on Life and Livingness

I wonder at people ever trusting a drug company. I really do. Click the link for details on the case.

Seems like my nutritional products (180+ ingredients in my NutriBlast Greens Plus powder and 218 ingredients in my top nutrition bar) were 10 years ahead of the curve…

Researchers are just discovering Obesity, Diabetes, Cardiovascular Disease, Autoimmune Diseases, Celiac, IBS, Crohn’s, Skin Disease, Allergies, Neurological Conditions, Autism, Cancer… all these chronic and terminal diseases START in the gut. The great news is they can also be HEALED in the gut. This docuseries reveals how…

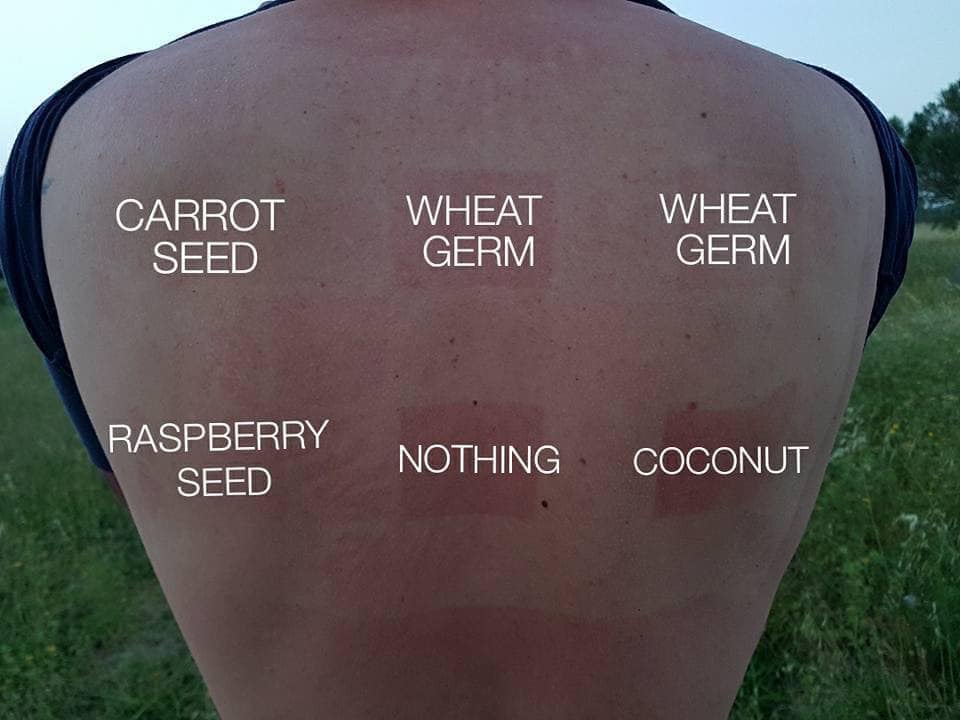

All #natural Sunblock!!!!

“If you are looking for an effective and 100% natural sun protection for you and your children, one that is not only non toxic, but actually #nourishing for your skin and body, this is a post for you.

A Number of plants produce oils with sun protective properties and I have been using them exclusively for the past 3 summers here on Mallorca, including on the skin of my now 20 month old daughter, who has never been touched by commercial sun screen.

Few days ago I decide to test a bunch of them on my husband who agreed for me to use his completely pale skin as a test subject and you can see the results on the attached pictures. This is from 1 hour exposure 15:00 to 16:00 on Mallorca, Spain.

Here are the brands and oils tested:

Nutritional Content and my experience of using the oils:

Carrot Oil

Rich in Carotene and Vitamin-A, both of which are powerful anti-oxidants, it helps promote youthful and supple skin.

Fushi – organic, cold pressed Carrot Oil

Orange in colour with a delicate smell of beta carotene (you know it if you ever took beta carotene supplements).

This oil requires little care in handling because of its colour, which can rub onto your clothing.

The good news is, in my experience it does not stain permanently and washes off without a problem and it also gives your skin a nice sun kissed glow.

I’ve used it on its on to maximize the sun protective factor or diluted with coconut or wheatgerm oil.

I use it on my skin during the mid day sun, without ever getting burned.

Wheat Germ Oil

Wheat Germ Oil contains high levels of Vitamin E as well as other vitamins, minerals, protein, linoleic, oleic, palmitic, and stearic fatty acids. This oil helps dry and cracked skin, Eczema, stretch marks, dull complexion, scars and sun burns.

Organic Wheatgerm Oil – Naissance Convive

Light brown in colour with a nice and fresh smell of unripened wheat grain if you ever had the pleasure of smelling it. It give the skin nice glow. Based on the result of my test, this brand seems to be more sun protective than the oil produced by Balenos Therapy.

Balenos Therapy – Wheat Germ Oil

This oil is light brown/orangy in colour and has a slightly toasted smell, similar to the smell of crushed mature wheat grain.

It strains a little when not rubber in entirely thus you may want to be careful when wearing light colour clothing.

The bottles are plastic and have a convenient applicator which makes using it easier, however the slightly toasted smell may not be to everyones liking. It also seems less protective to the other brand.

Raspberry seed oil

This oil is a very rich source of essential fatty acids and Vitamin E. The polyphenols help improve skin tone and elasticity and aid skin regeneration. It also helps maintain moisture while offering anti-inflammatory properties.

Raspberry seed oil cold pressed Neissance

Light gold in colour and with an appealing, fresh and leafy smell similar to the aroma of freshly dried hey.

This one is ideal to use on the face and on areas that tent to get burned easiest such as nose and shoulders. It undoubtedly has a very highly sun protective properties and I would recommend it to anyone with pale and sensitive skin, including babies.

As we all have different skin color and sensitivity to sun, I would encourage you to start with the oil with higher factor like Carrot Seed Oil or Raspberry Seed Oil and observe your skins tolerance and reaction to find what works for you. Re-applying is also essential.

Most importantly what I would like you to get out of this is that, there are safe and natural alternatives to commercial sun screens, which can be purchased in health food stores or online (I get mine from Amazon.co.uk).

Also, it is estimated that between 4,000 to 6,000 metric tons of sunscreen end up in the oceans worldwide, resulting in 10 percent of coral reefs being threatened by sunscreen-induced bleaching.

Last year Hawaii went as far as trying to ban sunscreen all together to protect their coral reefs. By adopting new practice of using natural oils over commercial sunscreen and by sharing this information with our family and friends we can help protect the oceans and ourselves from unnecessary toxins.”

(Copied & Pasted – Please Share!)

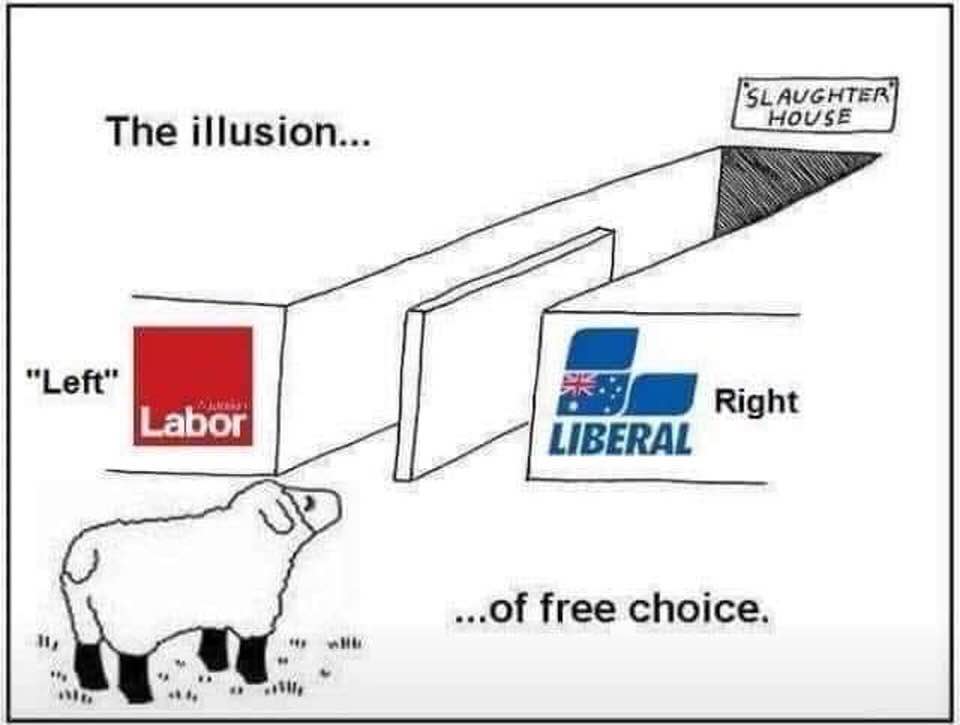

Australia faces an unmitigated disaster in the housing market and, consequently, the banks. Every indicator in the housing market is suddenly very bad. What we are witnessing is shaping to be a bigger property crash than the 1890s depression. And like the 1890s land crash, when most Australian banks failed, the banks today are in deep trouble, from their massive exposure to mortgage lending and derivatives on that lending.

With a federal election under way, why isn’t this an election issue? The political establishment is deliberately ignoring it, assuming that the Reserve Bank will magically solve the problem through various forms of money-printing that will be futile but will, as outspoken economist John Adams charges, “rape the dollar”. But be under no illusion: this coming crisis is also the reason the government and Labor rushed through “bail-in” laws in February 2018, which give bank regulator APRA the power, in coordination with the RBA and the Bank for International Settlements in Switzerland, to prop up the banks that will soon start to fail by confiscating the deposits of their customers.

Housing catastrophe

The only reference to this looming disaster in the election campaign is in relation to Labor’s negative gearing policy, which the Liberals claim will crash the housing market. No, it won’t be the cause of a market crash, because that is already happening—right now!

As of April 2019, CoreLogic’s figures show average price falls from the peak of the market in capital cities are 9.7 per cent. The two biggest markets, Sydney and Melbourne, are down 14.5 per cent and 10.9 per cent respectively. Melbourne’s fall started later than Sydney’s but is going faster—in fact, Melbourne prices are falling the fastest in its history.

CoreLogic, the media and property spruikers have jumped on figures that show the falls are slowing down: the national market was down 0.5 per cent in April compared with 0.7 per cent in March, 0.9 per cent in February and 1.2 per cent per month before that. Headlines proclaim the market is “through the worst”. More likely, however, the figures are being distorted by the rise in unreported sales results. Experienced property analyst Louis Christopher of SQM Research tweeted on 4 May: “Don’t be fooled by the artificially high clearance rates, today. Very high unreported rates meant the real auction clearance rate was considerably lower. I think right now, dwelling prices in Sydney and Melbourne are still falling. There remains much uncertainty out there.”

From all other indicators there is no sign of anything that can halt the plunge:

In April, credit growth into housing dropped to the lowest rate on record—just 4 per cent. Because the housing market is already a bubble, this figure needs to be much higher to push up prices, but following the royal commission banks have tightened their lending standards. For instance, according to CBA’s online “how much can I borrow?” calculator, for an income of $80,000 the bank will now lend around $350,000, compared with $460,000 in November 2017. Prices will only grow if the banks are willing to lend higher and higher amounts, not lower. For that reason, APRA is being lobbied to lower the benchmark interest rate at which loan affordability must be calculated from 7.25 per cent to 6 per cent, but that doesn’t mean that cautious banks will suddenly be willing to lend more.

Defaults on greenfield development lots in Melbourne soared to 27 per cent in the March quarter, up from 2 per cent a year ago, and 12 per cent before Christmas; Sydney is almost as bad at 26 per cent. These are investors running away from their deposits, rather than paying the balance on lots that are plunging in value. Ground Zero for the looming crisis in new developments could be the far northern Melbourne suburb of Donnybrook, which has the highest mortgage stress in Victoria and where sales in 2019 have fallen off a cliff—multiple greenfield developments are being laid out along Donnybrook Road that someone has to pay for. Click here to watch John Adams and Martin North’s newest video post: Heaven Help the Poor Souls of Donnybrook!

Dwelling approvals in March 2019 fell by 27.3 per cent from March 2018, and 15.5 per cent from February 2019.

Mortgage stress and mortgage delinquencies are on the rise, despite low interest rates and, supposedly, low unemployment and inflation. ANZ admitted last week to an inexplicable jump in 30-day and 90-day arrears on repayments, with the biggest 90-day increase in Western Australia. Establishment economist Christopher Joye proclaimed in his 25 March great debate with John Adams that “mortgage repayments as a share of income are actually quite low” and that record mortgage “debt serviceability, at this point in time, is perfectly fine”. But a few weeks later Joye revealed on the professional social media platform LinkedIn that his analysis for his clients was that risks on residential mortgage-backed securities (RMBS) are “rapidly rising” and that mortgages have “the highest arrears rates since the GFC”. Meanwhile, over a million households are in mortgage stress, which means they are struggling to meet monthly repayments that are way over 30 per cent of their income.

The number of households in negative equity, meaning that they owe more on their mortgage than their home is now worth, is also soaring. This doesn’t just leave households underwater, but it has a knock-on reverse “wealth effect”, as much consumer spending of recent decades came from homeowners borrowing against the equity in their homes, which they can no longer do. Contrary to the statistics, real inflation as seen in the rising cost of living is not low, and neither is real unemployment when underemployment is taken into account, so the drop-off in consumer spending is going to be devastating to the already fragile economy.Australia’s major banks have concentrated around 65 per cent of their lending in mortgages, far higher than any other banks in the world. On top of that, they have made trillions of dollars of derivatives bets on those mortgages, which three of the Big Four are trying to hide. They are in near danger of a massive crash, but the only preparation that authorities have made is the bail-in laws they snuck through Parliament in February 2018 so APRA can seize deposits in an emergency to try to prop the banks up.

The government should be tackling this crisis head on, drawing on the lessons of the 2008 crash in places such as Ireland and the United States. If the authorities in those countries could have acted before the crash to avert a disaster, what would they have done?

First, accept the necessity for a major government intervention into the banks, which the government will have to bail out anyway.

Impose a firewall between the banks and the real economy with a Glass-Steagall separation of normal commercial banking from the speculative investment banking where the banks hold their dangerous derivatives—that way the investment banking side can collapse without impacting the real economy.

Scrap any plans for bail-in, and place the banks under government administration to fully protect depositors and the daily business of banking while they are thoroughly cleaned out and reorganised.

Direct the Auditor-General to audit the banks in depth, to ascertain the true size of the bad mortgages and other bad debts, and the nature of the derivatives contracts that will need to be unwound and cancelled.

Enact a moratorium on foreclosures and repossessions of family homes to avert a social catastrophe until house prices stabilise and mortgage debts can be written down to reflect the new, much lower prices.

Start planning and executing changes to the general economy to move beyond its present concentration in housing bubble-related construction and financial services, beginning with a nation-building infrastructure construction program, financed by a national bank, which can revive and revitalise regional industries and towns and draw population growth away from the overcrowded capital cities. These are policy solutions the Citizens Electoral Council is fighting for, in this election campaign and beyond. Either ignore the crisis at your own peril, or join the CEC today in fighting for these solutions.

What you can do

With the election under way, contact all of the candidates in your electorate to ask:

What are you doing about the housing and banking crash?

Will you oppose and repeal bail-in?

Will you support the CEC’s Banking System Reform (Separation of Banks) Bill 2019 https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/Bills_Search_Results/Result?bId=s1172, which is currently before the Senate, to break up the banks?

When he was an Outback Australian doctor he found 50% of the Aboriginal babies he vaccinated died from the vaccine. So he started looking. Dreadful thing looking. It explodes all sorts of lies the authorities would have you believe. Bad for population control. But I recommend it strongly for your survival!

Faith and begorrah! What will they come up with next!